If you’ve been following this blog you will know that I’ve been primarily focused on trying to catch the structural bull thesis in oil over the past few years. The journey has been full of painful set backs and as of today I’m sitting on significant paper (Gear Energy) and realized (CRC) losses.

I often feel frustrated and feel like giving up. But in a way the pain I’m experiencing makes sense to me: why should it be easy to earn 20%+ IRRs in an asset class? If it was easy, anyone could do it.

Trying to time a commodity cycle is extremely hard because of the number of variables involved. The market tests your long-term conviction regularly by doing the exact opposite of what you expect. Whether it was US Shale’s remarkable resilience, the Saudi oil flood in 2018 or the US-China trade war, the market has tested and tortured the oil bulls in a variety of ways. Cheap has stayed cheap, or gotten cheaper and even more patient investors have thrown in the towel.

But if you have stayed true to logically analyzing the long-term supply / demand trends, I think you are close to being rewarded.

The Deal With Oil

The Coronavirus has caused an unprecedented demand shock to the global economy. Being cyclical, oil has been hit worse than most asset classes. It is estimated that oil demand has dropped ~25-30% (25 – 30mm b/d) in response to the global containment measures. This is unlike anything the world has seen in generations. As expected, the result has been a large supply surplus and rapid inventory builds. Landlocked crude prices have gone into negative territory as domestic storage is close to being breached. What was considered a textbook / hypothetical scenario is now playing out in reality.

While it may seem to most observers that this is the end of the oil sector, it is important to keep in mind the laws of the universe as penned down by Isaac Newton: the severe demand action we are seeing at the moment is being met with an equally severe reaction on the other side of the equation (i.e. supply). Oil is a cyclical asset and you can’t go through such a severe demand impact without having severe supply repercussions. The current situation will ultimately create an oil price shock of historic proportions since a lot of the oil production getting shut-in will be unable to come online immediately post a recovery.

When will this recovery happen? How long do investors need to wait?

My view is that the rebalancing in oil markets will happen faster than most are assuming. The consensus view is currently forecasting large inventory builds which will test global storage capacity. Because it will take months (if not years) to drain these excess stocks back to normalized levels, analysts are forecasting low oil prices for the foreseeable future.

The problem with this analysis is that it ignores the logistical constraints of how oil gets produced, transported, refined, stored etc. The world has ~1bn barrels of spare storage capacity, but most of this will never be accessed due to transportation bottlenecks. Let me explain why.

Take for example a landlocked crude like WTI. Because of the severity of the Coronavirus demand shock, refiners are in a situation where they risk having to write off their product inventories if they continue to produce more refined product. Products like gasoline have a limited shelf life (1 – 3 months) and therefore refiners are trying their best to drain their current inventory. This means they have to completely stop buying and refining additional crude oil.

As refiners have stopped buying crude, the entire crude transportation infrastructure is grinding to a halt. Local storage is filling up quickly and pipelines have stopped accepting crude volumes from producers as there is no where to store the oil. This means producers need to shut in production as soon as possible or simply throw the oil away. This is what is happening at Cushing, and the reason why the WTI May contract prices went negative; no one wanted to take delivery of the May crude as there was little / no storage space left domestically.

The TRC commissioner Ryan Sitton put it this way:

“You’re facing a situation where there’s so much demand destruction from people staying home because of COVID-19 and there’s so much oil flowing right now with no place to go. The supply chain is facing a problem and it backs up all the way to the gas stations.”

The bearish analysts who are forecasting that the entire global storage capacity will fill up are missing this point: the domestic land-locked crude will never make it to global storage as production will be shut in much quicker in response to transportation bottlenecks. The mechanism to make this happen is basin differentials / pricing which has gone close to zero or even negative in most land locked areas. When your oil well can’t cover its cash costs, it’s time to shut it down (the more you produce, the more you lose).

This is relevant for all crude oils that are lying behind long networks of pipelines such as the US, Russia and Canada. Crudes with easy water access will likely fare better and continue to trade near cash costs. This explains the relative strength of Brent prices.

So what does this all mean for oil? Here are the key takeaways:

- Producers are shutting in production faster than analysts are forecasting. Because of the breach in domestic storage and transportation networks, local basin differentials have fallen below operating costs, forcing companies to shut in production as quickly as possible

- As production shut ins accelerate, the large supply surpluses that are being forecasted will never happen and global inventory capacity won’t be tested (the land locked crude will never make it out to the global storage).

- If #1 and # 2 are correct and inventory doesn’t build as much as analysts are estimating, then when demand recovers and the market reverses into a deficit, the inventory overhang will go away faster leading to a quicker rebound in oil prices

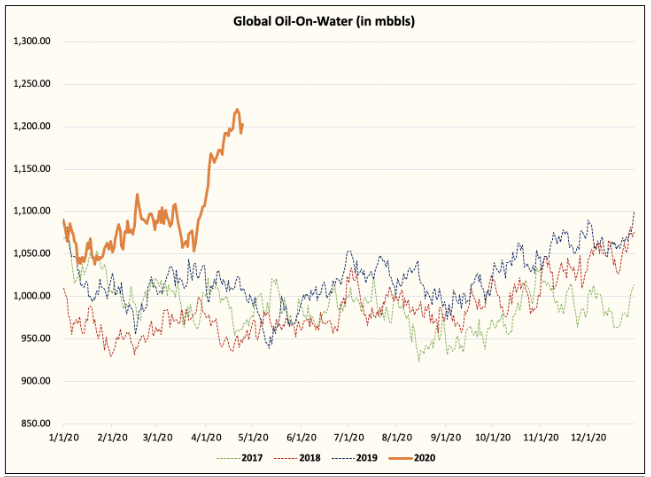

This train of thinking is further supported by the inventory data. To date, the total build in inventory has been far less than what consensus has been projecting. The builds also seem to be topping out.

Source: HFI Research

HFI Research estimates that combining the onshore and floating storage data, oil inventory has built by ~300mm barrels over the last 5 weeks. This would imply a global surplus of ~8.6mm b/d, far lower than the 15 – 20mm b/d+ that most analysts are forecasting.

This data indicates that either a) demand destruction has been less than estimated or b) supply destruction has been more than estimated. I think it’s probably a combination of both, but primarily (b).

The most recent global inventory data from Morgan Stanley shows that while the US saw a build in total oil stocks (crude + products), the global build was lower indicating the rest of world is drawing stocks already. It could be that demand rebound from China re-opening and supply reduction from OPEC coming into play have driven the rest of the world into a deficit over the past week.

Goldman Sachs recently came out with a report that agrees with this view and estimates a return to global deficit by June, with inventories normalizing by Q2 2021. They assume a 3.6mm b/d structural demand loss going into 2021 due to 1) lingering social isolation measures 2) permanent change in behaviour such as working from home that will reduce commuting 3) lower incomes 4) lasting impact on cruises and jet demand. Post inventory normalization, they forecast the oil market deficit to continue, leading to a constructive long-term outlook for oil prices.

To me, even the Goldman forecast feels quite conservative as there is a decent chance that we develop drugs / vaccines that can be mass distributed and which would lead to full normalization and recovery of oil demand (i.e. no ‘structural’ demand loss).

Stages of Recovery

The recovery in oil will happen in three stages. The first stage starts at the gas pump. As demand recovers, gasoline inventories at the pump will go down and they will eventually pull down refinery storage. As product storage starts to get drained, refiners will see an uptick in margins / crack spreads and will start demanding / running crude again (gasoline will probably do better than diesel as commuting demand will pick up sooner vs. mass transit, airplanes etc.).

As refiners start to demand crude again, the crude stock builds will start topping out and time spreads will start to strengthen. We are (hopefully) in this phase already as crack spreads have started to rebound, storage builds are getting slower and the contango in oil futures is getting less steep. All these data points need to continue trending in the same direction for us to be confident we are in phase one.

During this phase oil prices will probably stay at or below cash costs ($25 / bbl) as any sustained rally above this price would lead to some crude supplies coming back online and be detrimental to the re-balancing effort.

The second phase of the recovery will involve the market moving into deficit and stocks starting to draw down consistently. During this phase, spot prices will again be capped due to the excess inventory overhang. But as the market slips into deficit, we could see spot go above the cash costs (maybe $30 – $40 / bbl) to incentivize some of the lower marginal cost supplies to come online and take market share. This should start happening as soon as H2 2020, assuming the global economy starts re-opening without any glitches. The key data to watch during this phase will be inventory draws and the shape of the futures curve which should be flat or going into backwardation to incentivize oil to come out of storage.

The third and final phase is when inventory is normalized and keeps going lower due to the structural shift lower in supplies. This is when the oil bull thesis finally starts in earnest as the world wakes up to the massive structural damage done to the upstream sector and the difficulty of bringing enough supplies online to cure the deficit.

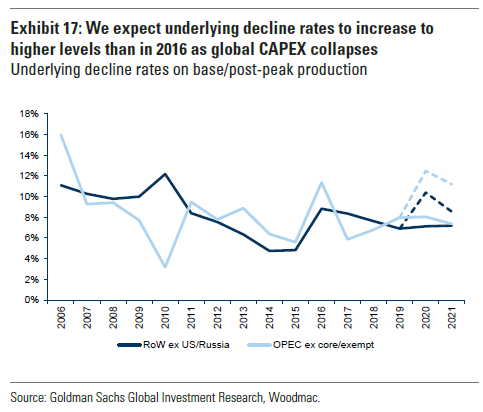

As we have learned from Venezuela, Iran etc. once you damage the capital stock for oil producers, it’s extremely expensive to repair and restart. This is unlike a normal manufacturing process which can usually be shut down and restarted with minimal friction. Once an oil company shuts in a well, it may never restart the well as it may be uneconomic to do so until oil prices are much higher. Decline rates accelerate due to the lack of maintenance capex. This is especially true for older, depleted wells that are less productive.

A significant percentage of wells will also remain shut-in as companies (especially smaller producers) will lack access to external capital. The cost of capital for the entire sector has gone up, which means (all else equal) lower supplies. Some of the over-leveraged producers have started filing for bankruptcy already. The majors will likely consolidate the assets coming out of these bankruptcies. As oil prices rise, instead of investing in production growth they will use the free cash flow to pay dividends and buy back shares to attract investors back to the sector.

GS estimates that the upstream sector will lose 5mm b/d of supply capacity as a result of these structural changes.

Once we enter this final phase of the recovery, oil prices will spike to $60 – $70+ and stay there for several years until new investments are incentivized. This will be the new secular bull market for oil and oil equities that I have been patiently waiting for.

How To Play This

I think natural gas will be a major beneficiary of the structural changes to US oil supplies. In terms of timing, I think natural gas prices could rebound in the short to medium term (Henry Hub June contracts are spiking above $2.00 / MMBtu as I write this) and therefore I’ve taken a significant long position in natural gas already. I wrote about this in detail here.

Once we go from phase 1 of the rebalancing to phase 2 (likely in the H2 2020), I will move some money from natural gas towards refiners and E&Ps. Refineries should see their margins and profitability improve before the producers. As end-demand recovers, product storage will get drawn down first, product prices will rally (relative to oil price) and crack spreads will improve. CRAK is a is a refinery ETF that I might consider buying to take advantage of this.

Finally, for the longer-term (phase 3 and beyond) I want to have a concentrated long position in the upstream sector. Obviously, one has to be extremely careful which upstream companies to invest in given the severe financial pressure in the short term from lower oil prices.

I think the best way to play phase 3 is through Canadian oil stocks. Generally speaking, Canadian oil companies have lower decline rates, lower leverage and lower operating costs per boe relative to their American counterparts.

In response to high oil price volatility and egress issues (from the lack of pipeline capacity) over the last couple of years, most of them have become extremely lean in terms of their cost structure and balance sheets and will survive and thrive post this crisis. They are also getting more support from their Federal Government relative to their southern neighbors.

On April 29, Bloomberg reported that Justin Trudeau was working with the Business Development Bank of Canada (BDC) and Export Development Canada (EDC) to structure financing solutions for the oil sector. BDC will provide mezzanine financing (debt that can be converted to equity) for as long as four years. Loans will be interest-only until the end of the term.

The EDC on the other hand will step in and provide a back stop for oil companies’ credit facilities that are no longer covered by reserve value.

Oil producers and banks renegotiate their credit lines semi annually based on reserves value. Since the value of those reserves is determined using STRIP pricing, many companies may find that their credit limits are reduced at a time when they need liquidity the most. This backstop will be for 75% of a bank facility for up to $100mm, for at least one year.

The combination of these two programs means that pretty much all Canadian producers with low to moderate leverage will get bailed out/ survive. Both BDC and EDC are fully owned by the federal government.

Finally, Canadian oil companies have another tailwind working in their favor: Transmountain and Keystone XL pipelines are moving ahead. After years of regulatory / political grid lock, the pipelines the Canadian oil sector badly needs are finally being built. While there is still a risk of construction delays and legal challenges, there is a good chance that at least one of these projects will be completed. This will structurally lower the WCS-WTI differential and provide a strong boost to producer cash flows in the coming years.

Gear Energy, a small cap Canadian heavy oil producer, has been the largest position in my portfolio since I started writing this blog. I have made no changes to my holding in Gear and I remain extremely optimistic regarding the company’s prospects. I will write a update article on Gear later.

Another attractive way to play the Canadian oil thesis is through the ETF XEG (S&P/TSX Capped Energy Index). XEG offers investors exposure to the large cap, integrated Canadian oil companies Suncor and CNQ (which make up almost 60% of the portfolio). You also get some upside torque through mid-cap and more levered names like Cenovus, MEG and Baytex.

Since I already own a very large position in Gear Energy, my game plan is to build a large position in XEG in preparation of Phase 3 of the recovery and to have >50% my portfolio in Gear and XEG for the next couple of years.

The beauty of XEG is that despite its heavy weighting to the majors and low-risk characteristics, there is a potential for a 2 – 3x return in the coming years if the structural bull thesis is correct and valuations recover to the 2010 – 2014 levels. Based on 2019 distributions, you are also getting paid a 5% dividend yield (which is likely to go much higher if we return to a world of sustainably higher oil prices).

Brief Note on CRC

I sold out of CRC due to the reasons stated here. It was a very painful decision as I had a lot of intellectual and financial capital invested in the company, but I think it’s the rational thing to do. I think it’s very unlikely that CRC’s lenders will allow the company to draw on its credit line simply to make interest payments to the junior debt holders. The company has simply too much debt to survive through the various recovery phases I laid out above and restructuring is the most likely path forward.

The lesson to learn from this is to avoid the temptation of quicker / higher returns through financial leverage. One can say that I got unlucky as the Coronavirus situation was impossible to predict, but at the end of the day I realized a permanent loss of capital which will take a long time to recover from. As I was selling CRC I was reminded of the famous Warren Buffet quote that rule #1 is to “never lose money”, rule #2 is to “never forget rule #1”. And Charlie Munger’s quote: “a long list of numbers multiplied by zero is still zero”.