I’m moving this blog to Substack. Going forward all new pieces of writing will be posted on saadkhan88.substack.com.

The Trouble With Inflation

I’ve been following the inflation debate quite closely this year and thought I would pen my thoughts down. Friday’s CPI report showed that inflation in the US had moved up to 6.8% YoY, while core inflation (ex food and energy) was ~5%. These are the highest numbers since 1982 and 1991 respectively. Since April this year, YoY inflation has been >4% while core inflation has been >3%.

The US government and the Fed continue to insist that the drivers fueling inflation are ‘transitory’, including one-time base-effects (2020 base numbers ‘artificially’ low due to the economic impacts of COVID-19), and have kept fiscal and monetary policy in expansive mode.

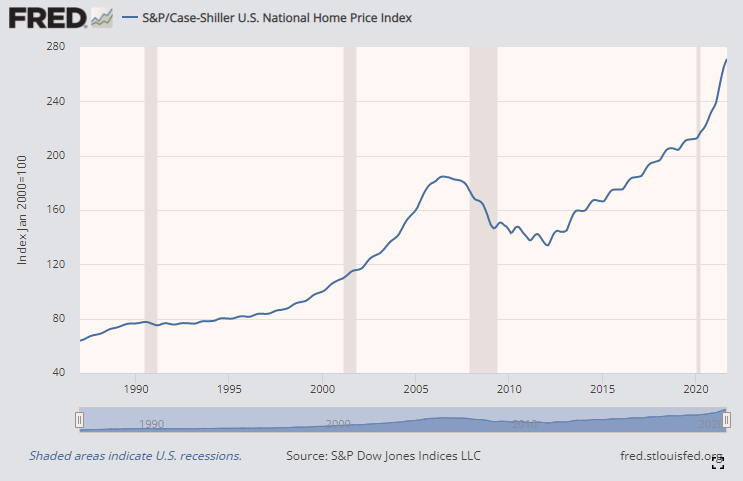

Recently Jerome Powell admitted that the word ‘transitory’ is no longer appropriate when talking about inflation, but at the same time the Fed appears to be in no rush to increase interest rates. In fact, despite the stock market and the housing market being at or near all time highs, the Fed thinks the market still needs >$100bn of liquidity injection per month. The Fed will be buying $105bn of treasury and mortgage-backed securities in December (down from $120bn in November). Quantitative easing is expected to continue into mid-2022.

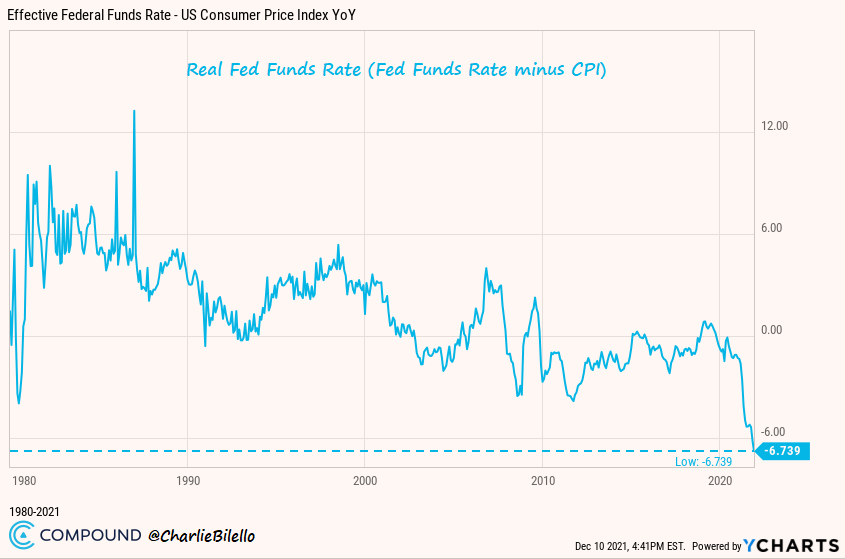

The current ‘real’ Fed Funds rate is now deeply negative, and the lowest in 40 years.

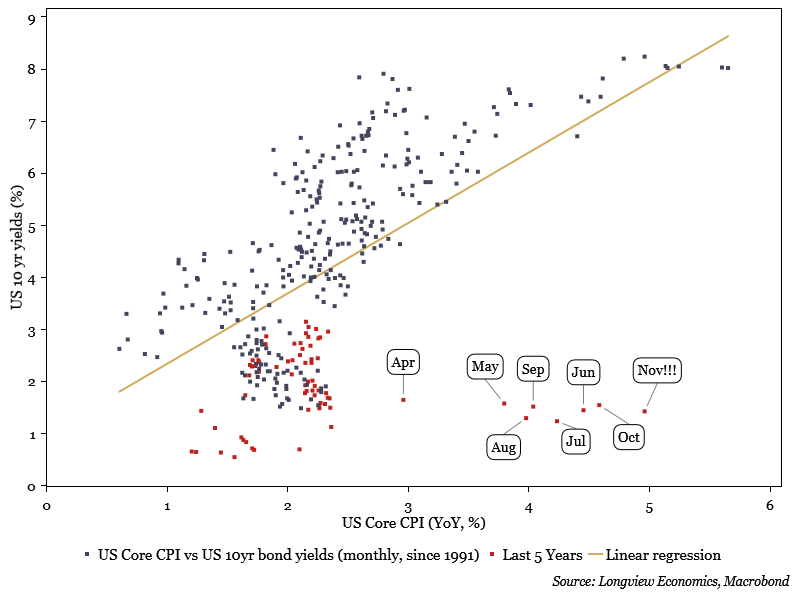

Treasury yields have also become deeply disconnected from the historical relationship to inflation (see regression below). This perhaps indicates that the gradual increase in indebtedness over the past ~50+ years has led us into a new paradigm where interest rates can’t be raised without severe financial and economic repercussions.

The Fed now faces a conundrum which many smart / prescient people saw coming many years ago: If the Fed keeps interest rates at near zero it risks inflation getting out of control and the stock market and housing bubbles to continue expanding to even more dangerous levels. On the other hand if the Fed starts hiking it risks a major economic correction given the high level of indebtedness in the economy and high duration in financial assets.

It’s important to remember that the financial market response to interest rate hikes is more sensitive to rate of change vs. the absolute level of interest rates. A 1% Fed Funds rate might seem low on an absolute level, but represents a 4x increase from current levels. To put this in perspective, it took the Fed 3 years (2015 to 2018) to gradually normalize rates from 0.25% to 2.5%, and even then the markets ‘cried uncle’ in December 2018 with a ~20% drop in the S&P500 and the Fed had to put its rate increases on hold.

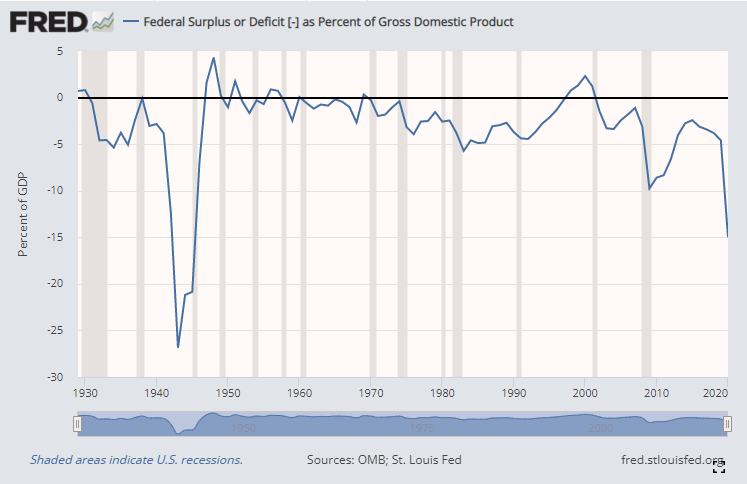

Rising rates will also make financing the fiscal deficit and rising debt levels a much bigger problem. The US is currently running the largest fiscal deficit since the WWII period with a $3t+ deficit in 2020 and 2021 and a $1tr+ deficit projected for 2022:

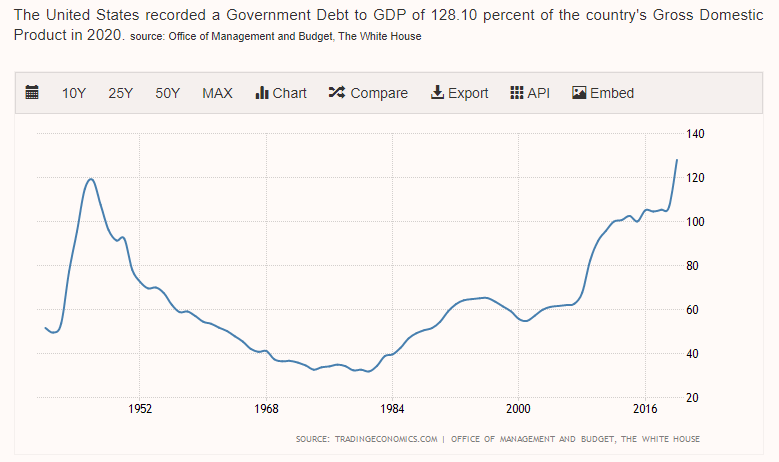

Debt levels have also risen to record levels with US government debt to GDP at >120%, another post WWII record:

Fed interventions in the corporate credit markets have led to a surge in corporate debt levels, with corporations having increased their debt levels by ~$1.3tr since the start of the pandemic.

So in summary we have an economy where inflationary pressures are rising, but where the most important tool to fight this problem (interest rates) can’t be used due to the economy’s extreme sensitivity to changes in interest rates. The only way out is for inflation to come down on its own (i.e. hoping the ‘transitory’ mantra turns out to be true), but I don’t think this will be the case. Here is why.

I believe that inflation over the last few decades has been low primarily due to four key reasons (in no particular order):

1/ Low velocity of money circulation

2/ Globalization (China in particular) as a global deflationary force

3/ Bear market cycle in commodities resulting from over-investment in capex during the last cycle

4/ Technology

While I do believe that some of the drivers of inflation are transitory – for example pandemic induced supply chain issues and ‘revenge’ spending / ‘pent-up’ demand will eventually mean-revert – I also think we need to pay close attention to changes in the above four ‘structural’ factors which could impact price levels for years to come.

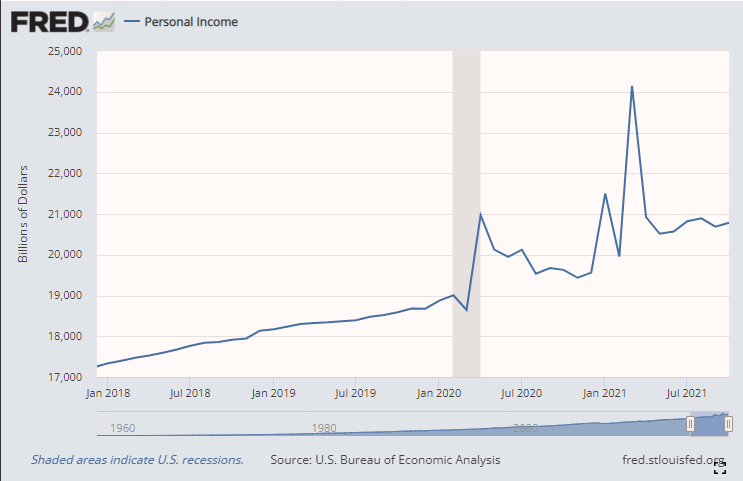

Let’s start with velocity of money. Rising asset prices combined with stagnant real wages and a lack of fiscal stimulus to supplement the Fed’s easy monetary policies have been major contributors to the low velocity of money and low inflation of the past decade. But in 2020 we had a big shift in this dynamic with the US government spending ~$4tr in fiscal stimulus to offset the impacts of COVID-19. While a lot of this stimulus money went towards filling cash flow gaps resulting from loss of employment income, a significant proportion went directly into people’s pockets in the form of savings and household de-leveraging.

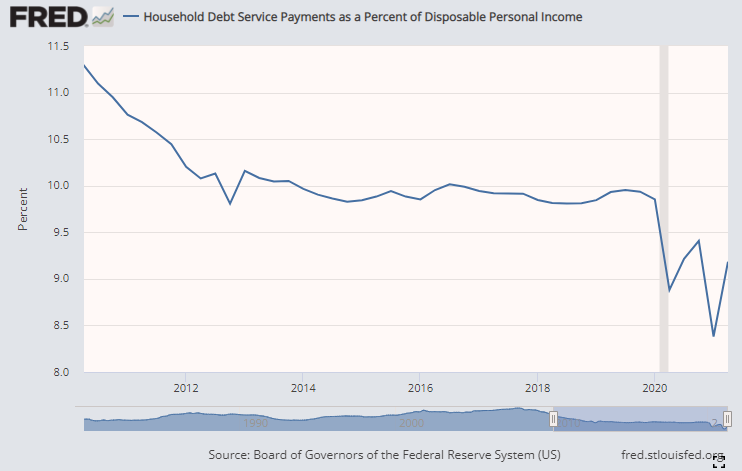

Household debt servicing costs as a % of disposal income have taken a significant step lower thanks to low interest rates and manageable debt levels. Meanwhile personal income continues to grow at a healthy rate as a result of the stimulus checks, generous unemployment benefits as well as rising wages.

Combine this with increased retail participation in the stock market, crypto boom and rocketing home prices and you can see how, for the first time in a long time, the average US consumer feels empowered to spend more.

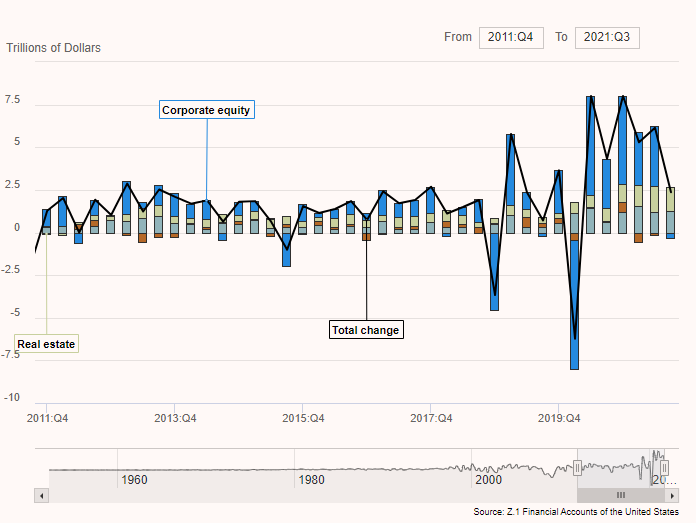

Change in household net worth from Q4 2011 to Q3 2021:

Since the Q1 2020 stock market crash, household net worth has sky rocketed and this is impacting not only personal spending, but also workers’ negotiating leverage with employers. After a very long time it feels as if the balance of power between capital and labor is shifting more towards labor with people quick to quit jobs (the ‘Great Resignation’) and increasingly reluctant to take on jobs that don’t pay the appropriate salary and benefits.

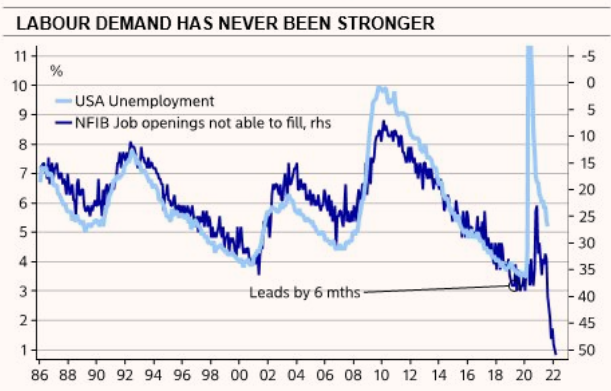

The National Federation of Independent Business (NFIB) conducts surveys of small businesses to assess labor demand, wage pressures etc. amongst other things. The results of a recent survey are quite illuminating as Nordea Bank summarized in the following four charts:

This data combined with the Biden administration’s plans for spending hundreds of billions on infrastructure and green energy suggests to me that the demand for labor and upward wage price pressures might be stickier vs. the past.

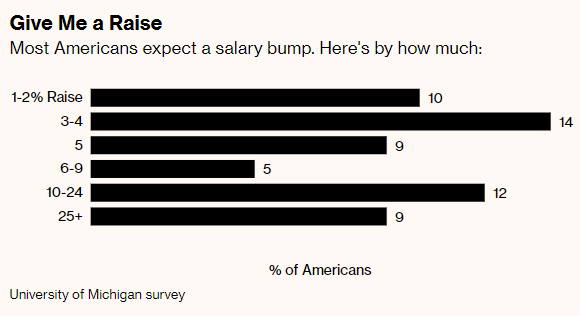

A recent survey by the University of Michigan shows that 1 in 5 Americans expect a wage increase of 10%+ next year. If workers are able to successfully secure such wage increases, expectations of wage increases could get embedded in their psychology leading to more consistent wage increases year after year, which eventually feeds into the prices of goods and services. This would lead to structural, multi-year upward pressures on inflation.

To summarize, the large financial asset bubble combined with significant changes to fiscal policy and labor markets could mean a structurally higher velocity of money as the lower and middle classes feel empowered to spend more and catalyze a wage-price feedback loop. This could make the current inflationary dynamic very different from the dynamic last decade.

Turning our attention to globalization, it’s no surprise to anyone following global markets that globalization is in retreat. Foreign trade as a % of global GDP peaked in 2008 at ~61% and recently took a sharp turn lower catalyzed by the US-China trade war of 2019 and further exacerbated by COVID-19 which exposed supply chain dependencies and increased calls for more ‘in-sourcing’.

Take semiconductors as an example. Currently the majority of semi conductor fabrication happens in Asia with Taiwan and Korea having a large share. US semiconductor companies have chosen to go ‘fabless’ and outsource manufacturing to companies like Samsung and Taiwan Semiconductor Manufacturing (TSM). This poses risks in the event of a US-China conflict (given China’s close proximity to these critical manufacturing facilities). Nvidia (NVDA), for example, is a fabless semiconductor company that is reliant on TSM to make their chips.

Recently Intel has agreed to invest in the development of new fabs and has been pushing the US government to provide subsidies to chip manufacturers who choose to do so domestically. Moving semiconductor manufacturing back to the US will increase resilience, but also increase price pressures. Facilities like the proposed Intel fab cost hundreds of billions of dollar to develop and require highly skilled labor to build and operate which will cost more in the US than in Asia. There are many such examples under Biden’s ‘Buy American’ and ‘Make It In America’ mantras, but they will only be accomplished at the cost of higher end-prices to the consumer.

Despite the political pressures to in-source, a lot of manufacturing will continue to be outsourced to places like China. But even there, important demographic and socio-economic changes are threatening the labor cost advantages that once acted as a strong deflationary force.

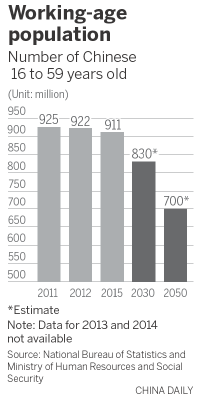

As China lifted hundreds of millions of people out of poverty over the last couple of decades, its population started demanding more than just basic sustenance. Wages in China are on the rise and workers are demanding more pay, more benefits, better workplace environments, less pollution etc. All of these are exerting upward pressures on the cost of production in China and are likely to continue as China pursues its ambitions to become a consumption-driven economy vs. being reliant on investments, manufacturing and exports. On top of this, China’s birth control policies have led to a significant demographic headwind that the government is trying to reverse but will likely take decades to accomplish.

This year China allowed couples to have three children, up from the two child policy initiated in 2015. However China’s birth rates have been stubbornly low as couples have found it difficult to afford raising a family with rising property prices, cost of living and environmental issues. This is the impetus behind China’s recent focus on the idea of ‘common prosperity’; the idea that corporate wealth should be redistributed and some essential services like online learning should no longer be under a ‘for-profit’ model. Environmental and worker safety issues have also been on top of mind. Some would argue that the recent Evergrande saga signals the country’s willingness to let the real estate bubble ‘pop’, trading short term financial / economic pain for longer term stability and affordability in the real estate markets.

Keeping all of this in mind, it’s hard to argue that China will continue to be a source of plentiful cheap labor for the world to fulfill its manufacturing needs. There are other countries like Mexico or India that might work as alternatives, but it’ll take many years for these countries to develop the necessary infrastructure and train their labor force to displace Chinese manufacturing prowess in any meaningful way.

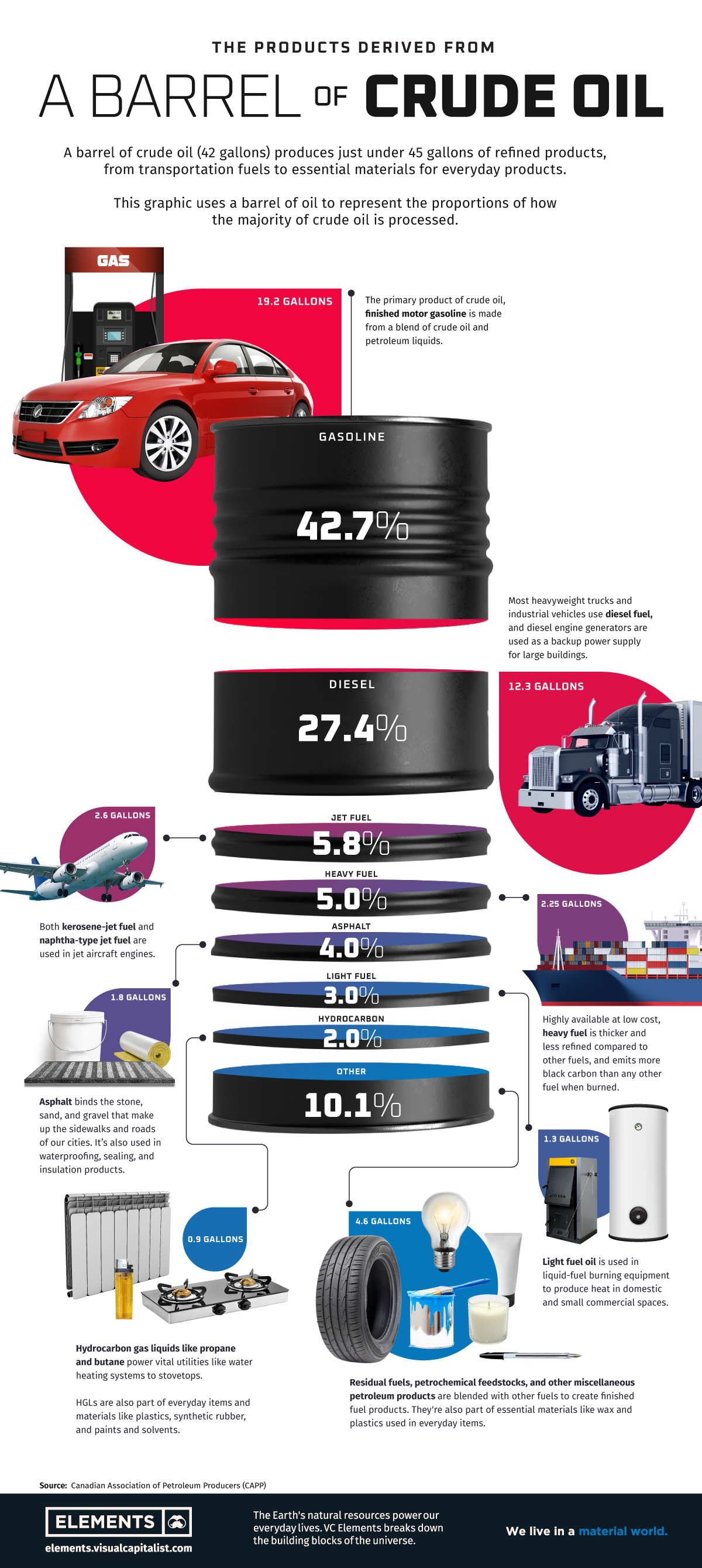

I won’t say much about energy prices here since most of the content on this blog has been focused on the impending energy bull market. But I will share a chart and a graphic that makes it clear how important oil is to the inflation puzzle. This chart from Lyn Alden (lynalden.com) shows how inflationary periods are usually accompanied by oil bull markets:

And this graphic from Visual Capitalists illustrates why this is the case. While most people think of oil as the fuel that powers cars, jets and ships, the bottom part of the graphic makes one realize that oil touches pretty much every part of our lives. Whether its asphalt in road, plastics, paint, synthetics, rubber.. you name it – it all needs oil to be produced. Higher oil prices therefore flow through into the price of pretty much everything you pick from the shelves.

While I believe technology will have a role to play in dampening the impacts of some of these factors – given the nature of inflation expectations, demographics, geopolitical shifts and commodity cycles, I doubt that the current progress in software, AI and digitization as a whole will be enough to offset structural inflationary pressures. I remember some tech folks telling me several years ago that oil prices were doomed because AI-based software would make oil exploration and extraction significantly easier and cheaper going forward. However, recent developments in the US Shale sector demonstrate that software can’t overcome the limitations of geology and the capital intensive nature of finite resource extraction. Progress in the world of bits and bytes doesn’t always translate into the world of atoms and molecules. And the latter is what the goods we consume are made up of.

Conclusion

The Fed is stuck between a rock and a hard place. If it continues its current policy, it risks losing credibility and hurting the well being of ordinary people as inflation eats away their spending power. Also, given the structural nature of inflationary pressures as described above, the Fed would risk getting inflation expectations out of control. On the other hand, raising rates will almost certainly lead to volatility in financial assets, credit contraction and potentially a recession. Given the high levels of debt in the system, there is a possibility that something could ‘break’, leading to systemic risks. As of this writing, a number of interest rate sensitive growth stocks have dropped 50%+ below their recent highs. While the broader indices have been stable, there is a lot of financial pain underneath as pretty much the entire basket of non-profitable growth stocks has been re-rated lower. If the Fed chooses to accelerate its tapering and hiking timeline, there will be a lot more pain to come. Ultimately if I’m right about the structural nature of inflationary pressures, the pain will be a lot deeper and unavoidable.

Going Down The Crypto Rabbithole

I’ve historically been dismissive regarding cryptocurrencies, especially given the numerous signs of speculative mania and colorful personalities involved. But recently, I’ve been starting to develop conviction that there is more at play here than a simple ‘tulip mania’ type phenomenon. The problem for investors is sifting the signal from the noise. And there is a LOT of noise. Whether it’s Elon Musk’s tweets on the topic, stories of teenage crypto millionaires, the sometimes gut-wrenching volatility in the prices of the assets, or the pace of new technologies and applications coming to market (e.g. the recent NFT craze)- it’s hard to figure out what’s really going on. A lot of conservative investors have decided to dismiss the entire sector as some kind of fad or bubble due to the abundance of speculative activity. Others have decided it’s too much work to sift the signal from the noise and have put crypto in the ‘too hard pile’. This could be a mistake.

As of this writing, the total crypto market cap is ~$2.7tr. Bitcoin alone is a >$1tr asset with backing from numerous large institutions (BlackRock for e.g.) and is becoming increasingly accepted as a superior store of value relative to traditional alternatives such as precious metals. As much as the ‘crypto is a bubble’ crowd would hate to admit, it seems increasingly likely that Bitcoin is here to stay. And there is more to the story than just Bitcoin. Tokens like Ethereum are opening up the potential for a whole new way of organizing and structuring the internet, the economy and institutions in a way that could overcome many of the limitations and failures of our current world order.

Decentralization

The technology behind blockchain and how it works is beyond the scope of this blog post, and there are countless resources on the internet that help explain the fundamentals (this is a great resource to get started). For this piece I’m going to keep the discussion focused on the problems crypto is trying to solve, how it uniquely solves them and some key topics to research before getting involved in the space as an investor.

The way I think about blockchain and cryptocurrencies (including tokens and other crypto assets… the distinction is important but doesn’t matter for this discussion) is that they solve a fundamental problem with how we have structured modern society, the internet and the economy: the properties of trust and power have become concentrated in the hands of a few, preventing frictionless collaboration and creating increased fragility and opportunities for the abuse of power; this is also exacerbating wealth inequality as the members in various centralized ecosystems are not getting the fair share of the value they add to these ecosystems.

For example, the largest technology companies are starting to look like monopolistic toll roads for economic activity. Want to market your business and sell products online? You have to pay a toll to Facebook, Google, Amazon, Shopify etc. Want to develop an app and sell it to millions of users? You have to pay a toll to the Apple App Store. Want to collaborate in a work environment? You have to pay a toll to Microsoft Teams or Slack.

This isn’t a problem limited to technology. Other large institutions like banks, insurance companies etc. have been generating toll-like revenue from our economic activities for much longer than Big Tech. Government institutions also tax our day to day activities in exchange for the promise of public goods and services, but often fail to to address burning structural problems like inequality and climate change that require short-term pain (which often reduces the government’s chances of re-election) in exchange for long-term results.

At this point you’re probably thinking I’m going to paint some kind of utopian picture of a world built on the blockchain, but that’s not where I’m going with this. Blockchain technology has its limitations, and it certainly isn’t a solution to all the problems I just listed. But it does address the root of where these problems originate: it’s hard to establish trust in society in the absence of centralized power and institutions. In doing so it offers a new tool kit to problem solvers to work on addressing these issues in ways that weren’t possible before.

Why do we pay a toll to Facebook? Because Facebook ensures that we can trust people are actually who they say they are in their online profiles (well not always… but they try). Facebook manages a centralized database of user identities which allows us to socialize online. Why do we buy things on Amazon? Because buying them directly from someone online exposes us to the threat of counterparty credit risk and counterfeits as well as the issue of figuring out transportation logistics. Amazon allows us to trust online counterparties and offers a streamlined online shopping experience. Why do we pay a toll to banks, law firms and insurance companies for day-to-day transactions? Because these institutions have the infrastructure and checks and balances in place to ensure the identity of various counterparties in a transaction and the validity of economic transactions and contracts. Why do we elect politicians to make decisions for us? Because we can’t trust each other to collaborate and work in the absence of a centralized authority in a way that advances broader society’s well being rather than just looking out for ourselves.

Trust is essential for capitalism and democracy to work, and while institutions have become ever more efficient at providing it, they have become dangerously powerful and are extracting an ever greater cost from society in exchange for offering it.

Double Spending Problem

Let’s bring this down to earth. A simple example of the ‘trust’ problem is sending money to someone over the internet. Because software has zero marginal cost of distribution, if I send a piece of code to someone that represents $1, it’s effortless for me to copy and paste that code and send it to someone else as well. That way I’ve spent $1, twice – the classic double spending problem. To avoid this problem we use intermediaries like banks and payments software to transfer money online in exchange for a fee.

This problem exists because of the fundamental nature of how software and computers today are architected: computers are controlled by humans, and humans can often alter computer programs with minimal effort. This means its hard to establish trust in a piece of code.

Chris Dixon of Andreesen Horowitz does a great job of explaining succinctly how blockhains solve this problem:

“I like to say that blockchains are computers that can make commitments. Traditional computers are ultimately controlled by people, either directly in the case of personal computers or indirectly through organizations. Blockchains invert this power relationship, putting the code in charge. The programming logic behind it is more complicated than we need to get into, but the end result of it is that blockchains, once established, are resilient to human interventions

As a result, a properly designed blockchain provides strong guarantees that the code it runs will continue to operate as designed. For the first time, a computer system can be truly autonomous: self-governed, by its own code, instead of by people. Autonomous computers can be relied on and trusted in ways that human-governed computers can’t.“

In the case of the double spending problem, the blockchain solution is to create a commitment to scarcity. Every Bitcoin has a unique identifier, and each transaction on the Bitcoin blockchain is verified and recorded into a database that can never be altered by anyone. The responsibility for security and preservation of this architecture is distributed throughout the network as opposed to one central authority. Through this genius architecture, Satoshi Nakamoto created digital scarcity and trust without the need for a centralized institution.

Based on how the Bitcoin algorithms are written, only 21mm Bitcoins will ever exist. And no centralized authority has the power to alter that. This means that Bitcoin is an excellent store of value for someone looking to hedge against the risk of monetary debasement. This is similar to gold which has a finite supply and a very high and well-defined stock-to-flow ratio (the amount of gold mined every year is fairly stable and a very small percentage of the overall stock of gold). But in some ways Bitcoin is even better than gold: 1/ it’s annual supply is completely fixed and independent of the price of Bitcoin (gold supply can and often does fluctuate with gold price) 2/ since gold is a physical commodity it can easily be mixed with impurities and sold fraudulently to unsuspecting buyers, whereas Bitcoin and the underlying blockchain can never be altered (except with an impractical/unfeasible amount of computing power) as this is the fundamental principle behind their design.

Moving Beyond Store Of Value

In a way digital trust is even stronger than the types of trust we place in physical processes such as signing a document, or visually inspecting a piece of art. These physical processes often involve human intervention and judgement whereas the blockchain relies on a much stronger security protocol rooted in cryptography.

Let’s extend this concept of digital trust beyond monetary ‘store of value’. Imagine if you could trust someone’s identity online without a centralized database and use this as the foundation of different types of online interactions (social, ecommerce/payments, collaboration etc.). That would allow us to move beyond the limitations and value extraction of Big Tech to a completely new type of internet (commonly referred to as Web 3.0) which is far more open, collaborative and offers better incentives to developers and programmers to develop the best technologies.

Similarly imagine everyday economic transactions happening on the blockchain – let’s take the example of real estate where there are multiple layers of trust required all the way from proof of ownership to proof of funds and identity. A decentralized repository of identities, combined with decentralized finance (DeFi) and a blockchain to record real estate transactions would mean a lot less involvement by banks and real estate lawyers to securely close real estate transactions. The concept of title insurance would disappear.

Billions of dollars are spent every year on copyrights / licensing. But with blockchains, verifying authenticity of content can be made a lot simpler and cheaper. When you buy a painting you usually need some kind of physical inspection or appraisal to ensure what you’re buying is original. But even then there is room for error as no inspection is 100% fool proof which is why art fraud is still fairly common. With Non Fungible Tokens (NFTs), every piece of digital art is associated with a token on the blockchain which acts as a certificate of authenticity. When you buy this piece of digital art, what you’re actually buying is the underlying token (which cannot be replicated) and the transaction gets added on the blockchain. If someone now tries to sell a fake copy of this piece of art, the fraud will be easy to detect as this individual won’t be able to present the original token as proof of authenticity.

Finally, let’s think about collective action, government and institutions. Today, we depend on governments to provide us with public goods and services because we have few good ways to trust each other and collaborate on such projects. We also rely on corporations to accumulate capital, labor and formulate and enforce the rules that allow us to work together to achieve certain economic objectives. However these centralized forms of resource allocation leave us exposed to abuses of power. Governments promise one thing and often deliver another, companies often change their original agreements with workers for the benefit of shareholders.

Using blockchain technology, these activities can be organized under Decentralized Autonomous Organizations (DAOs). DAOs are represented by rules encoded as a transparent computer program on the blockchain. Since these rules are agreed upon by the members of the DAO and cannot be changed by any one individual, DAOs do not require traditional governance structures such as boards of directors and executive officers. This ensures that the organization operates on a truly neutral and democratic basis. Every member of the organization has a “voice” through community governance and can choose to exit if the organization no longer meets their goals and principles by either leaving the network or selling their coins / tokens to someone else. DAOs are already being used for various crowd-funding projects including charity / donations, buying NFTs and group investments.

Down The Rabbit Hole

The potential applications of the digital trust created by blockchain and crypto assets are almost endless. Through the examples above I’ve tried to offer a small glimpse of the kind of future that’s possible with their application. The fact that some of the smartest minds in Silicon Valley are working on this, as well as the fact that the asset class as a whole continues to grow despite the constant dire prognostications of naysayers, suggests to me that this is not a transitory speculative phenomenon and could very well represent the seeds for the next big technological revolution. That being said, like with any other emerging technology investment there are countless risks associated with investing in crypto. Below are three major topics I think investors should research in detail as a starting point before putting a dime into these assets:

1/ Not A Monolithic Asset Class

As I mentioned the blockchain has almost countless applications / use cases. As a result investors should ensure they understand the specific problem any given blockchain application, token or coin is trying to address before investing. Treating the sector like one big monolithic project is a mistake. For example Bitcoin was initially thought of as a future means of payments but is increasingly becoming a store-of-value play. This is because transactions on the Bitcoin blockchain remain incredibly slow, the value of Bitcoin remains highly volatile, and the Bitcoin community has pushed back against changes such as increasing the size of each Bitcoin block to allow more transactions to be processed per second. Given the lack of development and resistance to change, there is a consensus forming that Bitcoin is the equivalent of ‘digital gold’ or a way of protecting your wealth against bad central banking policy.

Compare this to the Etherium blockchain which wants to use the properties of digital trust to build a lot more than just a monetary database. The Etherium blockchain is being used to build decentralized applications for a number of the use cases I discussed earlier including a repository for identities, decentralized file storage, decentralized finance (DeFI), DAOs, NFTs among others. The Etherium blockchain currency ETH lets you pay a network of computers to run various applications that are built on top of it and in that sense is more of a ‘token’ rather than a ‘currency’ and referred to as such in the community. The fee paid in order to process transaction on the Etherium block chain is knows as a ‘gas fee’ and varies depending on how busy the network is at any given time. Recently these gas fees have become extremely expensive during times of peak usage as the amount of traffic on the Etherium network continues to grow fast.

In order for Etherium to achieve the stated objectives of its founders (i.e. build real-world tools and applications on the blockchain that can be widely used all over the world) it needs to constantly evolve. There are currently various updates under progress to help the Etherium blockchain process transactions faster and to improve scalability. Etherium therefore embodies the Silicon Valley ethos of ‘moving fast and breaking things’. But this also means that Etherium has more competition. While Bitcoin has nearly monopolized the ‘store of value’ application for blockchains, Etherium is facing competition from a slew of new entrants like Cardano and Solana that claim to have found better solutions to the problem of scalability. For example Solana uses the concept of Proof of History (PoH) as a technological improvement over Etherium to process a greater number of transactions per second (~700K transactions / sec which is ~30x the number of transactions Visa handles).

To conclude, successful investment in crypto requires an understanding of the different types of crypto assets and their respective use cases. Without this understanding you won’t know the risk / reward implications of what you are buying and are therefore likely be surprised by the ultimate outcome. Buying a meme coin like Dogecoin exposes you to very different set of risks vs. something like Etherium which has a significant ecosystem of developers working on solving real-world problems on the blockchain.

2/ Regulatory Overhang

It’s no surprise that the decentralized nature of crypto assets has attracted a lot of illicit activity. By circumventing the banking system, Bitcoin has allowed many types of criminals all over the world to transfer / launder money with ease. Just this summer Colonial Pipelines paid $5mm in cryptocurrency to a group of hackers from Russia who infiltrated the Company’s systems and caused a days-long shutdown of a major gas pipeline that led to a supply shortage on the U.S. East Coast. The FBI somehow managed to acquire the private key to the cyrpto wallet where the assets were held and retrieved $2.3mm (the price of Bitcoin had fallen), but the fact that the hackers asked for ransom in Bitcoin goes to show the increasing preference of nefarious actors to conduct their business in cryptocurrency.

While it’s estimated that only 1% of crypto transactions involve illegal activity, and the vast majority of money laundering continues to be in the form of fiat currency, the ability to own cryptocurrency without divulging your identity and the fact that regulators are behind the curve in terms of technology has alarmed policymakers all over the world:

“Cryptocurrencies have been used to launder the profits of online drug traffickers; they’ve been a tool to finance terrorism,” Treasury Secretary Janet Yellen.

“Very few people are using Bitcoin to pay their bills, but some people are using it to buy drugs [or] subvert elections,” New York Times columnist Paul Krugman.

“[Bitcoin is] a highly speculative asset which has conducted some funny business and some interesting and totally reprehensible money-laundering activity.” ECB President Christine Lagarde

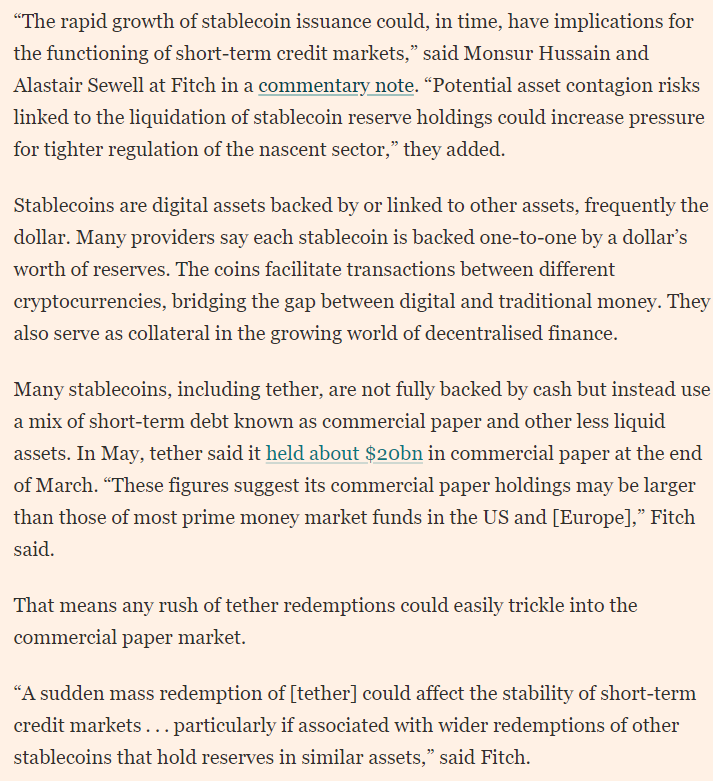

Additionally, the whole crypto economy extending beyond Bitcoin, Etherium and including all other tokens and meme coins continues to be unregulated and has turned a bit into the Wild West of the technology and financial world. The whole space is moving so fast that regulators are having a hard time keeping up with rising and continuously evolving forms of speculative activity. The creation of stablecoins and DeFi has led to an orgy of leveraged speculation in crypto assets manifesting in increased volatility and boom / bust cycles for many of the most traded coins as well as increasing the fragility of the entire system. The following passage from Financial Times captures the potential systemic risks posed by the asset class:

With the stablecoin market now $100bn+, regulators are starting to take note. On Nov 9th, SEC Commissioner Caroline Crenshaw published a statement on DeFi which should have rung the alarm bells for anyone in the crypto space taking regulatory risks too lightly. The statement makes it clear that while DeFi is ‘decentralized’, it’s still a subset of ‘finance’ and involves activities which have traditionally fallen under the SEC’s jurisdiction. I found the following few passages to be particularly noteworthy:

“But these offerings are not just products, and their users are not merely consumers. DeFi, again, is fundamentally about investing. This investing includes speculative risks taken in pursuit of passive profits from hoped-for token price appreciation, or investments seeking a return in exchange for placing capital at risk or locking it up for another’s benefit.”

“For example, a variety of DeFi participants, activities, and assets fall within the SEC’s jurisdiction as they involve securities and securities-related conduct. But no DeFi participants within the SEC’s jurisdiction have registered with us, though we continue to encourage participants in DeFi to engage with the staff.”

“That being said, for non-compliant projects within our jurisdiction, we do have an effective enforcement mechanism. For example, the SEC recently settled an enforcement action with a purported DeFi platform and its individual promoters. The SEC alleged they failed to register their offering, which raised $30 million, and misled their investors while improperly spending investor money on themselves. To the extent other offerings, projects, or platforms are operating in violation of securities laws, I expect we will continue to bring enforcement actions.”

These statements suggest that regulatory crackdown on the whole space is only a matter of time. While the SEC has chosen to use an enforcement framework for now, I think a broader regulatory framework for crypto is probably on its way. While such a framework will add a lot more transparency and certainty, it will likely also lead to short term volatility, de-leveraging and potentially massive losses for some investors and speculators exposed to activities that will be made illegal, or severely constrained in scope going forward. It may also end up making DeFi a lot more like TradFi.

Perhaps the biggest reason to expect regulatory crackdown on the space is that governments will not tolerate a potential loss of confidence in fiat money and the banking system as a result of cryptocurrency adoption. Modern monetary policy relies critically on the central bank’s ability to increase money supply to encourage credit creation, and for all economic actors to continue treating this money as the primary means of economic exchange. If cryptocurrencies continue to rise in value, people could start to view this increase as a sign of uncontrolled inflation or the debasement of fiat currency. Such expectations can be self-fulfilling as people could start hoarding crypto assets and anchoring wage expectations to their price, starting a wage-price spiral. Additionally if people move from the current banking system to DeFi platforms, then the channels through which central banks exert their power (i.e. injecting liquidity / credit creation, regulatory frameworks etc.) will be neutered.

Based on all the above, it’s not surprising that China and India have effectively banned all cryptocurrency transactions, and leaders in the developed world continue to speak in a cautious and increasingly threatening tone about the whole space. More national bans and restrictions are almost a certainty in my opinion.

3/ Buying and Storing Crypto

Most crypto is bought and sold on major exchanges like Coinbase, Binance, Gemini etc. When choosing an exchange it’s important to consider security features, fees and capabilities. Some of the smaller exchanges may offer lower fees but they leave you exposed to security risks (hackers have broken into exchanges and stolen assets). In general it’s best to stick to the largest exchanges that have backing from big venture capital and other institutional investors. It also makes sense to transfer your assets to a private wallet off the exchange if you’re planning on buying and holding significant amounts of cryptocurrency for the long term.

While most big exchanges will store your assets in a secure wallet, security is not their primary business. Make sure to choose an exchange that will allow you to move assets off the exchange and into a private wallet. A ‘hot’ wallet runs on internet-connected devices like computers, phones, or tablets which makes it quite convenient to access your assets and transact. But because it’s connected to the internet, a hot wallet is also exposed to online security breaches and threats. The safest form of crypto storage is a ‘cold’ wallet or hardware wallet which is not connected to the internet. This could be in the form of a USB or hard drive, but requires more technical knowledge to set up. A good way to set up your wallets is to have an exchange account to buy and sell, a hot wallet to hold small to medium amounts of crypto you wish to trade or sell, and a cold / hardware wallet to store larger holdings for long-term durations.

Signing up for an exchange usually requires setting up an account and verifying your identity by submitting government issued documentation (though some exchanges allow anonymous accounts). However this doesn’t mean that your identity will be revealed on the blockchain. Blockchains record all the transactions you and everyone else is making and share it with everyone, but these transactions are linked to every user’s public key, not their personal information. This makes the transactions anonymous, but not confidential. A public address is where the funds and assets are deposited and received but only a private key allows you to retrieve those assets or make transactions with those assets. Think of a public address on the blockchain like a mailbox and the private key as the mailbox key. Anyone can put mail into the mailbox, but only you can access the contents of the mailbox with the private key. This is why keeping your private key somewhere safe is essential.

Conclusion

While there is a lot more to be said on the topic, I hope this post has been a good intro on the potential applications of crypto and some of the key research topics and risks associated with the space for investors to dig into further. I’m still early in the process of doing the same and hope to write more pieces that delve deeper into specific topics. For now I have decided to allocate a small % of my net worth (~1%) to a diverse basket of crypto assets to keep me motivated to learn more. It could be that I’m too early, or that the majority of the assets in the space eventually implode due to regulatory or other factors, but given the enormous potential and asymmetric upside I think it’s a worthwhile topic for all investors to keep an eye on.

Why Neither OPEC+ Nor US Shale Can Do Much About The Energy Crisis

In May 2020 I wrote a piece titled “Portfolio Update: How I’m Investing Now” where I predicted that the oil market would rebound quicker than people were expecting. I laid out three phases of the recovery process, with the last / third phase being characterized by oil inventories falling below pre-COVID levels and continuing to draw because of the multi-year underinvestment in supplies and structural damage to oil production from oil well shut-ins. I wrote:

As we have learned from Venezuela, Iran etc. once you damage the capital stock for oil producers, it’s extremely expensive to repair and restart. This is unlike a normal manufacturing process which can usually be shut down and restarted with minimal friction. Once an oil company shuts in a well, it may never restart the well as it may be uneconomic to do so until oil prices are much higher. Decline rates accelerate due to the lack of maintenance capex. This is especially true for older, depleted wells that are less productive.

With oil prices hovering at around $25 / bbl and having just recovered from a trip to -$40 / bbl, what I wrote at the time was hard for most to believe and easy to dismiss. The ‘oil is dead’ narrative remained mainstream. Since then oil has nearly quadrupled to $80+ / bbl and inventories have not only normalized to 2019 levels but are on track to hit the 2018 lows.

Despite this drastic change in fortunes, most generalist investors remain skeptical of oil price recovery. The consensus narrative seems to be that OPEC+ has enough spare capacity to cure the deficit and that US Shale will eventually start ramping up production causing the market to slip back into surplus.

Since the oil and gas sector has been out of favor in the investment community for more than half a decade, these narratives are not surprising to hear. Most investors haven’t really focused on the structural changes happening in the industry and are still extrapolating from historical trends. There simply hasn’t been much incentive to conduct any deep study into a sector that represents <3% of the S&P500, and with recent ESG mandates the oil sector remains the farthest thing from what most institutional investors would consider to be a core area of interest. This is why I think the handful of energy specialists who have been tracking the underlying fundamentals over the last few years have a strong edge and will likely outperform the market strongly over the next few years . Under the gut wrenching month to month and year to year volatility in the oil markets are strong structural undercurrents that will completely re-define how the world thinks about oil and the energy sector more broadly.

To address these structural undercurrents I wrote a series of blog posts in 2019 titled “What Is The End Game For The Oil Thesis?”. In Part I I talked about how the world had been under-investing in conventional oil supply and how this would lead to increasing decline rates which would become impossible to reverse in the near term given the long lead times needed to sanction and build such projects. In Part II I wrote about why we can’t rely on US Shale to fill the gap from lack of conventional project capex. And finally in Part III I talked about why OPEC+ spare capacity is not as high as it appears. I also talked about the limitations to OPEC+ spare capacity in my most recent oil market update.

Since most investors haven’t been studying these changes in the industry, they are still operating under old / stale assumptions regarding supply growth and a false narrative of abundance. This extends to the political sphere with recent comments from the Biden administration displaying a shocking lack of understanding of the forces at play.

The result of this energy ignorance will ultimately be a steadily worsening energy crisis as politicians and investors continue to ignore the root cause of the problem and continue searching for short-term stopgap measures (e.g. SPR release, or oil export ban) or offer up completely unrealistic ‘green’ alternatives (e.g. switching completely to electric cars in the next couple of years).

Short term solutions like an SPR release will only briefly pause the rally in oil prices and will most likely result in governments needing to re-fill their SPRs at higher oil prices down the road. These reserves are intended as a backup / safety measure to ensure supplies in the event of a natural catastrophe or military conflict and are not a ‘real’ source of supply. An oil export ban ignores the reality that refineries require different grades of crude to operate. Domestic refineries in the US as an example would need to continue to import heavy / medium grade crudes from Canada and the Middle East to operate. An export ban would simply create an oversupply of lighter grade crudes in the domestic market and cause a widening of the WTI-Brent spread which would hurt domestic producers with no noticeable impact on gasoline prices to the end consumer.

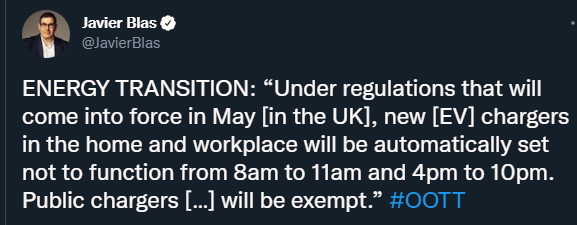

Even more bizarrely some world leaders are of the view that high oil prices are not a problem because we will all start driving electric vehicles in a few years and oil demand will collapse. The current global vehicle fleet is around 1.3bn vehicles, of which around 11mm are electric. Yes, that’s Billions with a B and Millions with an M. So with electric vehicles at just under 1% of the vehicle fleet, how exactly are politicians envisioning a drop in oil demand from EVs?

Assuming the global vehicle fleet grows by 2% a year, the number of cars on the road will increase by 25 – 30mm vehicles a year, so EV sales of 25mm-30mm are required (i.e. 3x the current EV fleet) just to keep oil demand FLAT. And this is assuming no growth in oil demand from air travel or petrochemicals which make up almost 60% of total oil consumption(!). Manufacturing EVs at this scale would require enormous volumes of raw materials like aluminum and lithium which are highly energy-intensive to produce. ~10% of oil demand comes from the mining sector. What do you think will happen to oil demand if we decided we wanted to triple the production of lithium and aluminum in short order? What kind of investments and lead time will be needed to produce these raw materials on such large scale?

Even if we leave all these issues aside and assume the world is able to miraculously achieve these absurdly unrealistic EV sales figures, the politicians will still need to address one more critical question: where will the power come from to charge the EVs? A quick look at the global power crisis and electricity shortages all over the world will immediately expose the vacuous nature of these claims.

Not only would the world need to invest massively in clean electricity sources, it would also have to develop the grid infrastructure (backup generation for renewables, charging stations etc.) to make mass EV adoption realistic. This is a multi-decade undertaking, not something that will be resolved over the next few years.

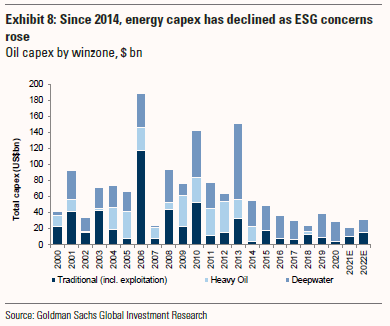

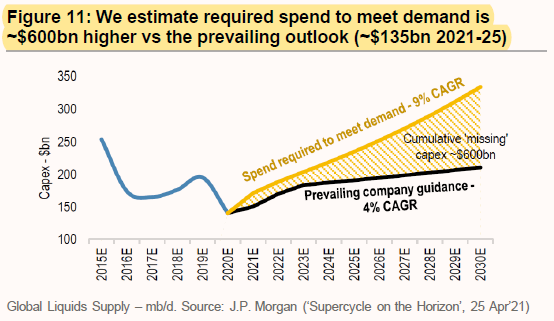

The root cause of the energy crisis which no one (except for a handful of specialist energy investors) seems to want to talk about is encapsulated by this chart from Goldman Sachs showing investment in the biggest oil projects they are tracking globally:

Here is another one from J.P. Morgan for a more comprehensive global oil capex outlook:

$600bn of ‘missing’ capex is not a problem that will be resolved by SPR releases or export bans. And wishful thinking about electric vehicle adoption and peak oil demand will only make this worse as it will continue preventing the necessary investments needed to ensure sufficient oil supplies for the future. In a way it’s already too late: even if oil companies started investing today, it’ll take 4-5+ years to bring new projects online which means that energy security will be a problem for the foreseeable future. With supply inelastic in the near term demand destruction will be the only way out, and it will happen not because of electric vehicle adoption as many believe, but sky high oil prices which will bring the world economy to its knees. The politicians and investors looking to OPEC+ or US Shale to increase supplies to lower oil prices should look at their own actions first. After sowing the seed for this energy crisis, they must now reap the consequences. Unfortunately it’s the working classes that will bear the brunt of their misguided policies.

Oil Market Headwinds Are Clearing

In July I wrote a three part update on the risks facing the oil markets and why it was prudent to de-leverage oil / energy positions until the outcome of the Delta variant wave had become a bit clearer. Since then, there have been a number of positive signs indicating that the worst might be behind us:

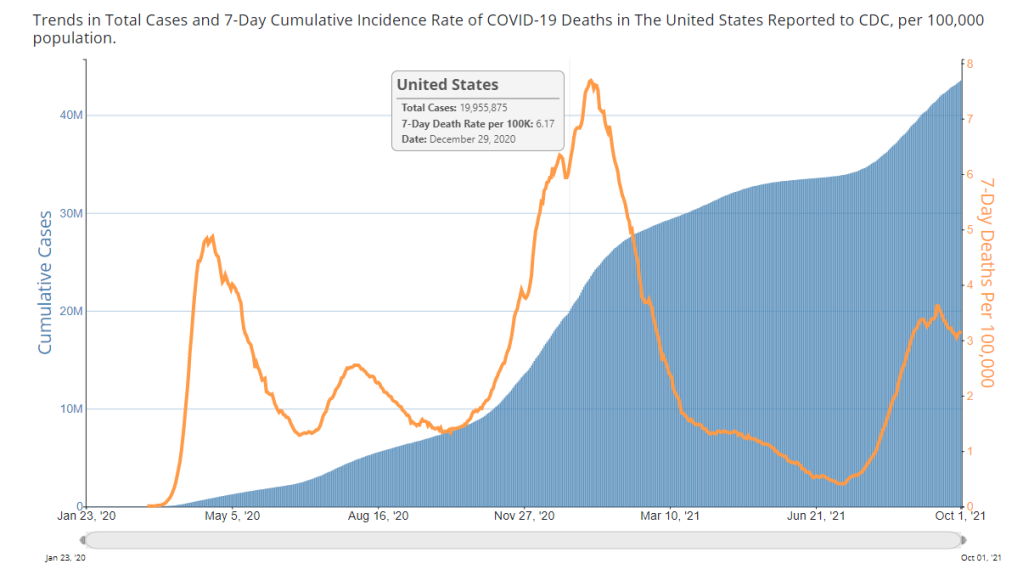

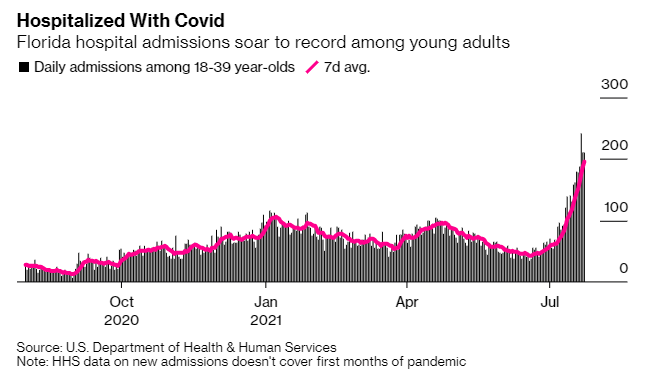

1/ Deaths have continued to be extremely low relative to cases in the United States, indicating that the vaccines are working and / or hospitals have become better at treating the disease.

The blue bars in the chart (left axis) above represent the cumulative total COVID cases in the US to-date while the orange line (right axis) represents 7-day average deaths per 100K people. The trend shows clearly that the current wave is a lot less deadly that the prior waves in 2020.

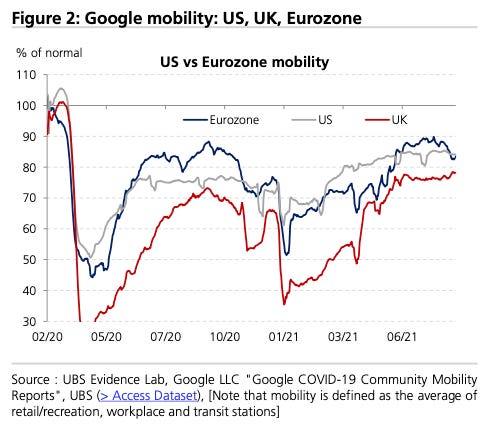

2/ Mobility has remained largely flat in the developed world over the last few months indicating that the era of lockdowns is coming to an end. It appears that both governments and the private sector are eager to continue on the road of normalization and don’t want to be held back in a ‘pandemic of the unvaccinated’.

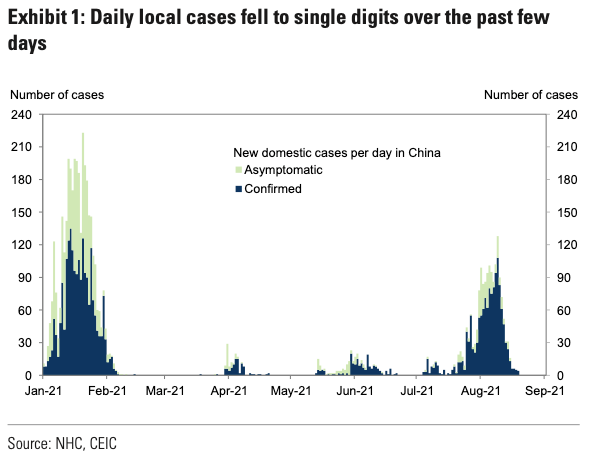

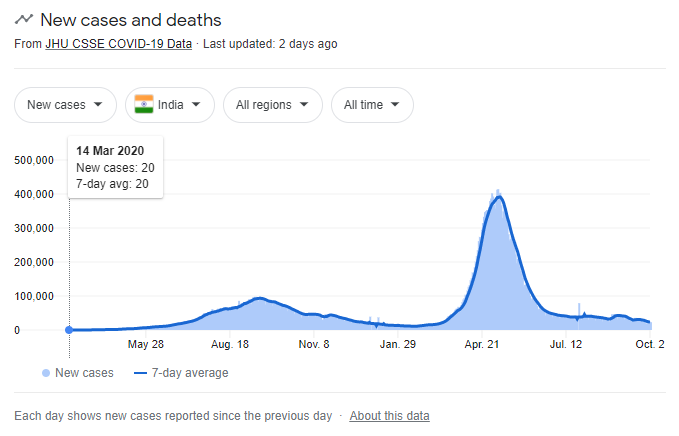

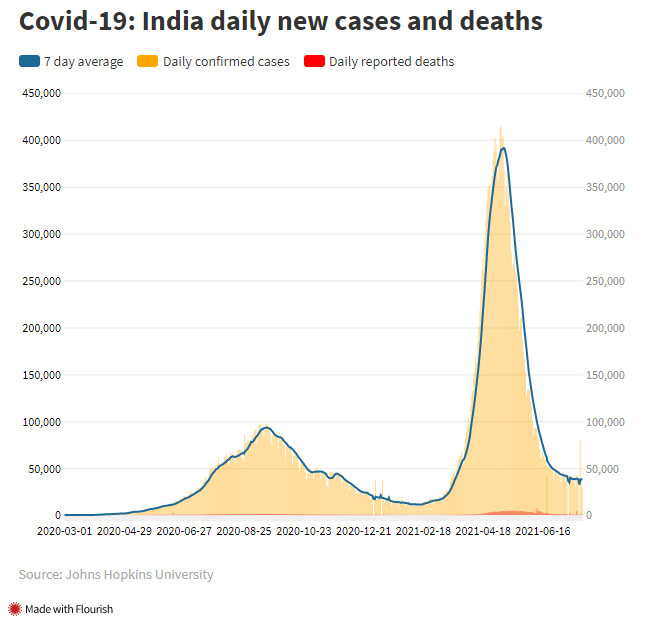

3/ Trends in Asia also continue to be positive with both China and India showing no signs of a major resurgence in cases.

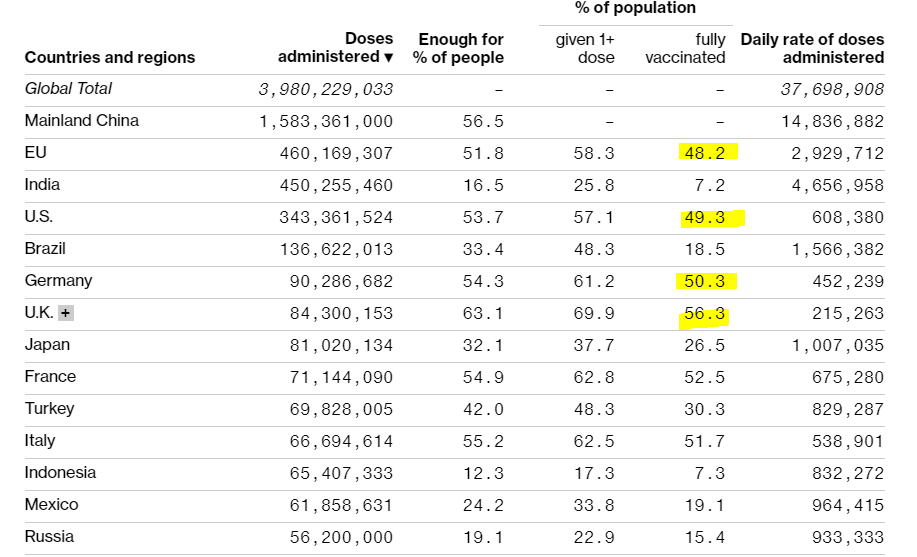

China has continued with its ‘no tolerance’ policy and managed to clamp down on any potential waves with short but strict lockdown measures, while India has also continued to experience very low case counts due to a combination of herd immunity and rising vaccination rates.

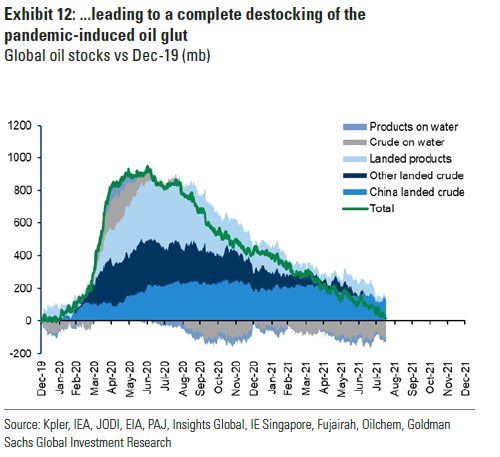

As a result of the above, the oil market has remained in a deep deficit with demand tracking at 98mm b/d and inventories continuing to draw strongly. Based on the latest global inventory data from Goldman Sachs the entire glut of oil inventory built over the pandemic era has been drained and the market is still in a 4mm b/d+ deficit (!).

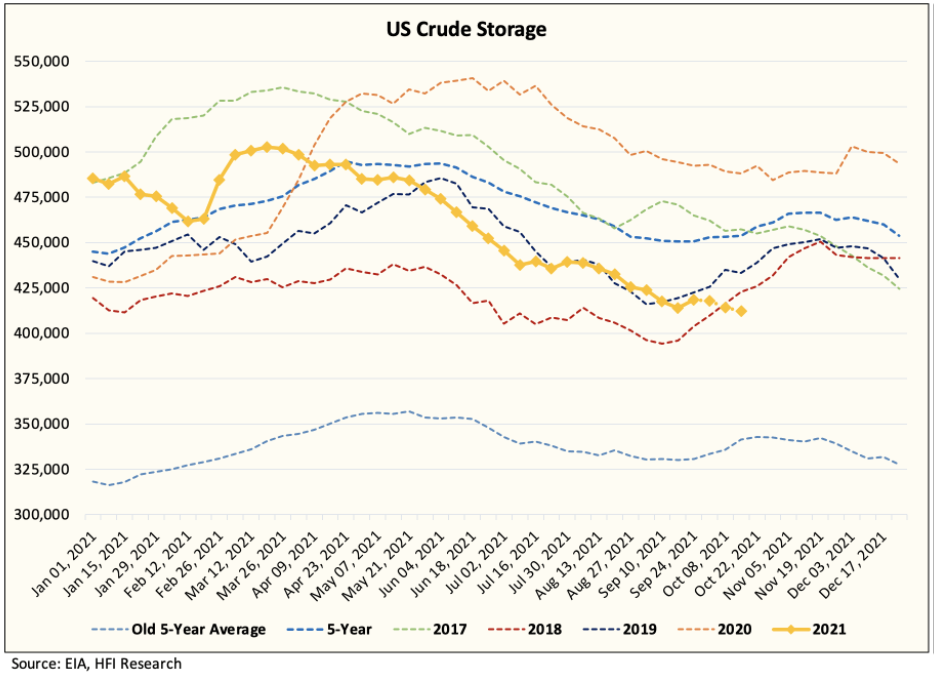

In the US, oil inventories are the lowest they’ve been in 5+ years with Hurricane Ida further accelerating oil storage drawdown with a 30mm bbls hit to storage and an ongoing 300K bbl / d production impact into year-end:

Last but not least (on the demand front), the global natural gas / energy crisis is likely to put additional pressure on oil demand this winter as a result of gas-to-oil switching. Global gas prices are currently trading US$180 / bbl on an oil-equivalent basis making oil the cheapest fossil fuel around. Most analysts estimate that gas-to-oil switching can lead to anywhere from 200K b/d to 1mm b/d additional oil demand in the coming months, depending on the severity of the winter season. At the higher end of the estimate (+1mm b/d, in a colder than normal winter scenario) an oil price in the triple digits is not out of question unless OPEC+ intervenes.

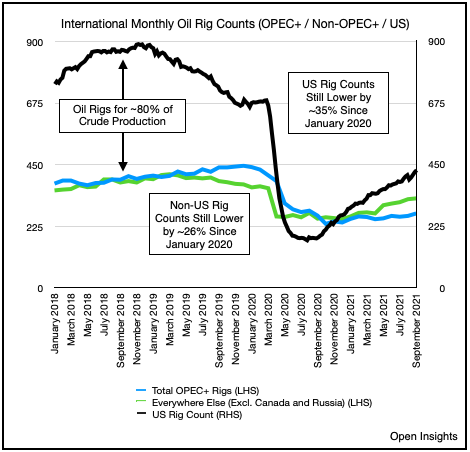

Turning to the supply side, rig counts, company statements / guidance and other data continue to suggest that supply is going to be a lot more inelastic this cycle vs. prior years.

While US rig counts are inflecting higher, accelerating decline rates, deteriorating productivity and renewed commitments to return capital to shareholders are going to prevent any meaningful increase in US output in the near to medium term.

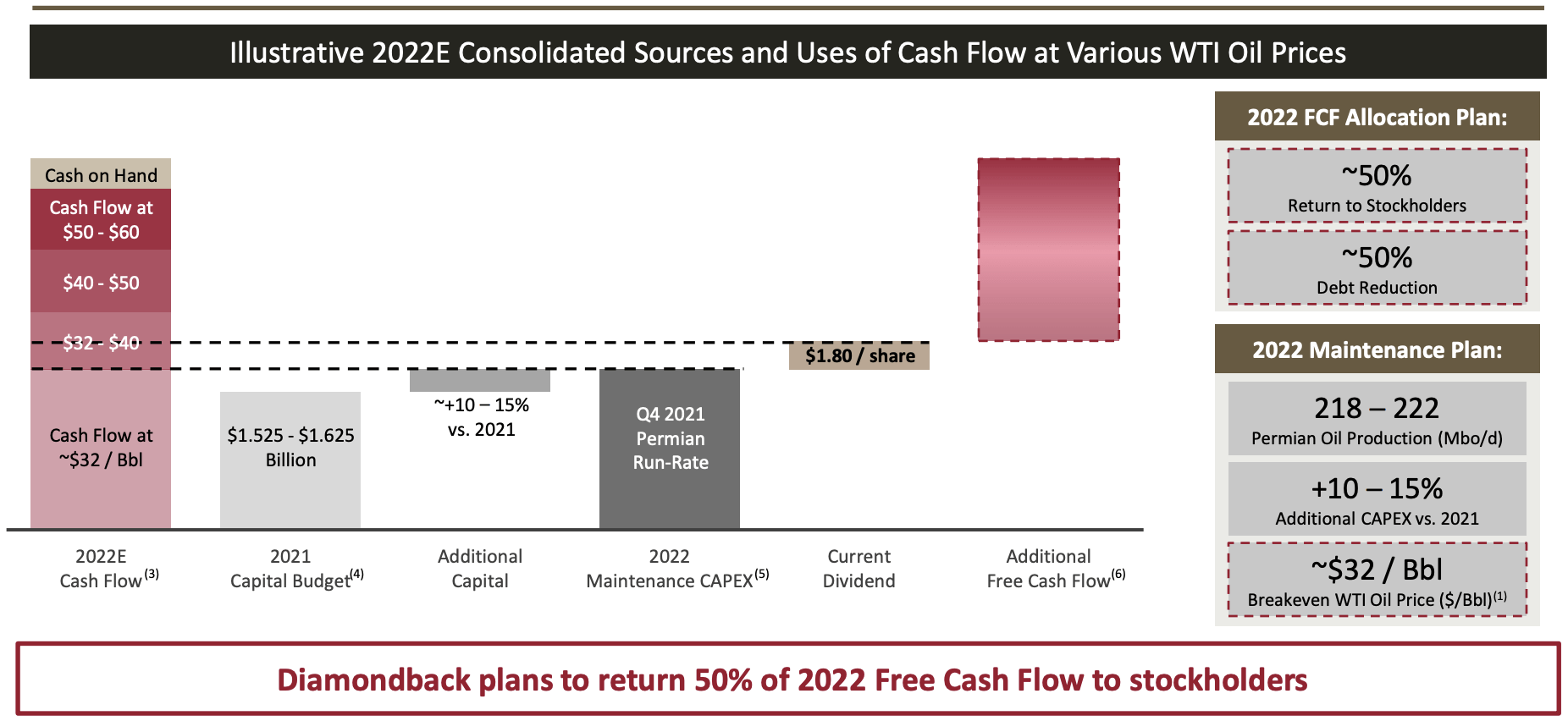

In a recent announcement one of the largest US oil producers (historically famous for its ‘grow at all costs’ strategy), Diamondback Energy, reiterated its commitment to return 50% of its free cash flow to shareholders:

Expect more US companies to follow suit as a combination of shareholder frustration with lack of capital returns and ESG mandates stymie any growth plans. The days of spending >100% of cash flow on production growth are over. Production growth of 3-5% is the new normal. With US production trending at roughly 11.5mm b/d, this equates to around ~600K b/d of supply growth which is not nearly enough to cure the 4mm b/d+ current deficit.

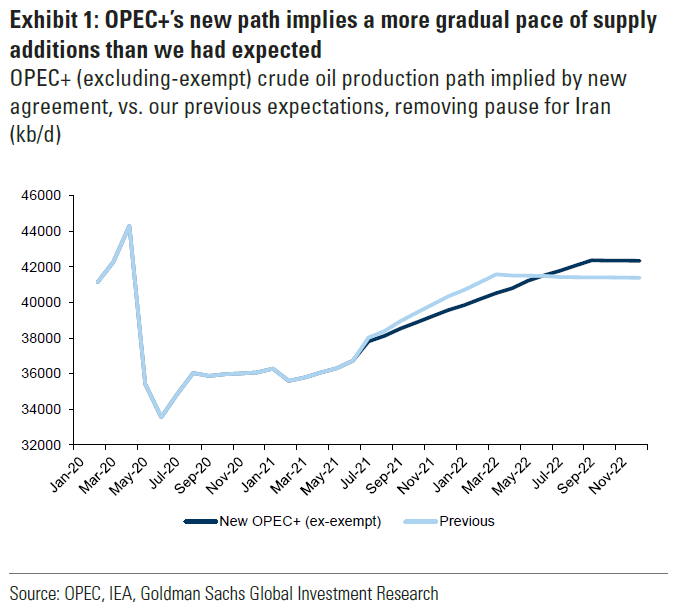

That leaves us with OPEC+. OPEC+ currently has 3-4mm b/d spare capacity. They have committed to increase production by 400K b/d each month going into 2022. If they feel pressured, they might increase this to 800K b/d, but they are unlikely to use up a more significant proportion of their spare capacity at this stage for a couple of reasons:

1/ After experiencing more than half a decade of low / volatile oil prices their fiscal budgets and balance sheets badly need higher oil prices for longer

2/ With Trump out of the office and Biden pursuing better relations with Iran, Saudi Arabia is a lot less incentivized to appease US concerns regarding high energy prices

3/ Increasing production pre-emptively may backfire if the winter turns out to be warmer than normal and the forecasted oil demand increase doesn’t materialize; this could be further compounded if there is a renewed COVID wave

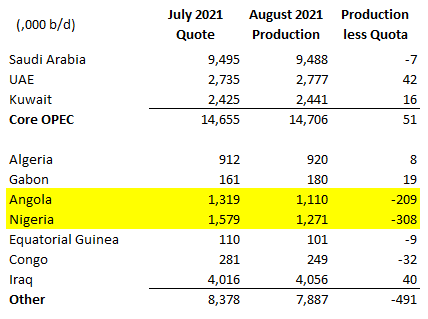

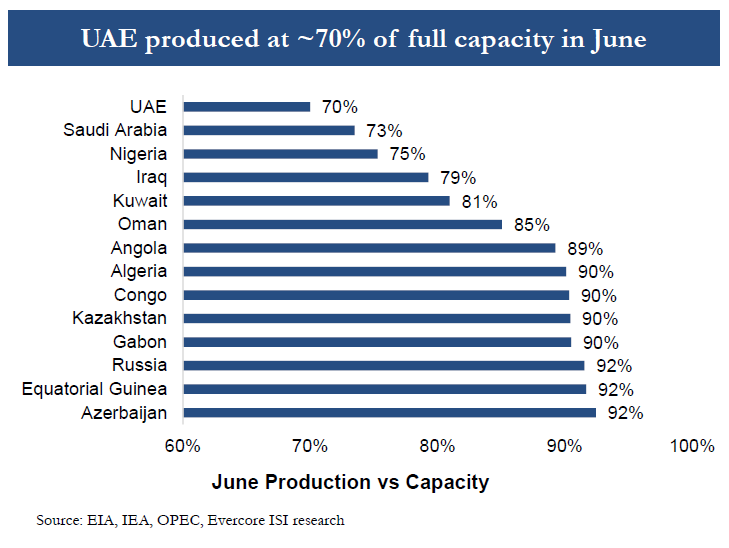

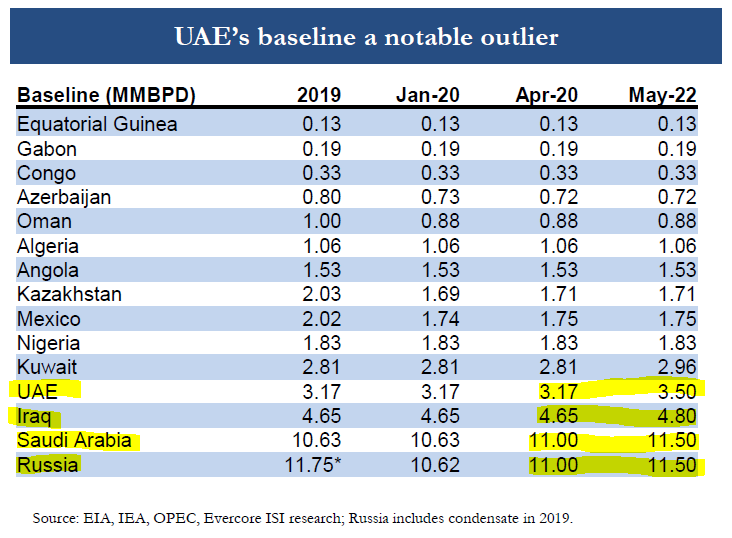

4/ OPEC+ production data continues to support the hypothesis that a couple of members don’t have the financial resources necessary to increase production and / or years of underinvestment in capex is starting to have its impact in the form of accelerating decline rates. Every member is incentivized to produce at quota to maximize revenues, however for several months a couple of OPEC+ members have continued to produce significantly below quota:

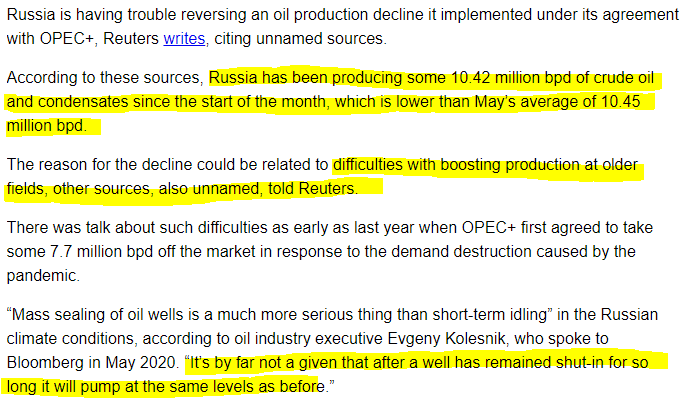

While countries like Saudi Arabia are known to have unilaterally cut production to support the oil markets in times of crises, it’s hard to imagine poor countries like Angola and Nigeria holding back production relative to quota out of the goodness of their hearts to benefit other oil producing nations. In Part III of my last oil market update I had also written about Russia’s struggle to increase oil production. All of this means that OPEC+’s actual spare capacity could be significantly lower than the ‘nameplate’ capacity which would argue for OPEC+ being more conservative about using up the remaining capacity.

Conclusion

The oil market headwinds I had written about in my last update are starting to lift. WTI has recaptured the critical $70+ level and energy stocks have also moved back up with XOP testing the key $100 level once again. With the world going into winter season facing an energy crisis as a result of natural gas shortages, there is a chance for an oil price spike which could lead to oil prices in the triple digits. While this would be great for a short-term gains, it would likely lead to a global recession and temper oil demand growth going into 2022.

I have positioned myself back to being fully long energy stocks. My playbook is to watch weather models carefully and observe how the markets are pricing winter weather risk. If we do get a colder than normal winter and a squeeze in oil prices, I might consider taking profits as such an exponential rise in energy prices will not be sustainable. If we don’t get a winter squeeze I believe oil prices will remain well supported in the $70-$75 / bbl range as the post-pandemic oil demand recovery will continue, and oil equities will continue to re-rate higher on a more steady basis given the tremendous cash flows and return on capital that will be possible. It goes without saying that keeping an eye out for COVID case counts globally, new variants and other COVID related tail risks is also going to be paramount. I’m keeping my head on a swivel and not getting ‘married’ to any of my trading positions.

Uranium – How Will The Squeeze Play Out?

On August 22nd, I wrote a uranium update concluding that investors should be buying the dip in uranium equities and that Sprott’s entrance into the market would be a game changing catalyst for the thesis. I wrote:

“All these developments can significantly accelerate the balancing of the uranium market as they increase the financial demand for uranium (in addition to the step change in physical demand that’s about to occur over the next few years as I elaborated on in my first article). We could potentially see a positive feedback loop where buying from the Sprott uranium trust leads to an increase in spot price, which in turn leads to more inflows for the trust from momentum chasing hedge funds / investors, which then leads to even more buying.“

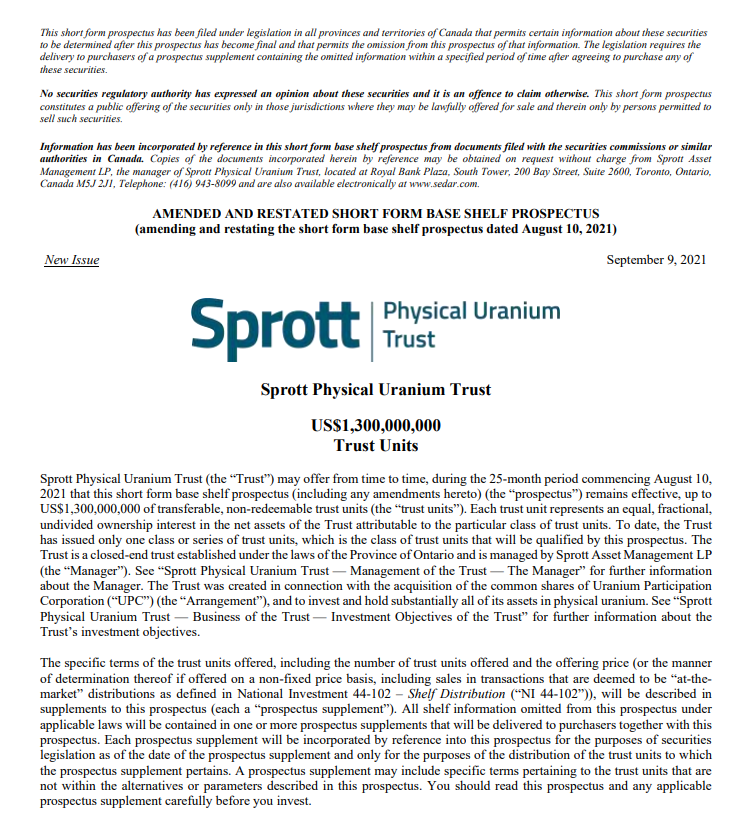

My timing couldn’t have been better. The very next day uranium equities started shooting up on the news that on August 20th the Sprott Physical Trust (SPUT) had purchased 600K lbs of uranium, in addition to the 300K pounds they acquired on August 19th (the first day of purchases). Just to give you a sense of what these quantities mean, a standard 1GW nuclear reactor requires 450K lbs of uranium a year. So within 2 days SPUT had taken in the equivalent of annual uranium supply for two nuclear reactors!

Given the strong demand / inflows Sprott started to quickly run out of room on the At-the-money (ATM) equity facility they had originally filed. On September 9th, with almost $250mm of capital raised (~80% of the original $300mm ATM size) and nearly 7mm lbs of uranium acquired, Sprott filed an update to the ATM facility, upsizing it from $300mm to $1.3bn! The news sent shockwaves through the uranium investing community and created a buying frenzy in uranium stocks.

The $250mm+ of purchases up to that point had pushed spot prices from ~$30 to $40 / lb. An additional $1bn was a recipe for a squeeze, and a wake up call for the utilities who had apparently been calling Sprott to ask what was going on (they are clearly far behind the curve). Spot price today is just inching above $50 / lb, a level many had never imagined seeing this year and the highest level in almost a decade!

If you had bought long positions in the sector on August 23rd, the returns have been impressive:

URNM +68.1%

URA +43.6%

U.UN (Sprott Trust) +50.2%

However this does raise the question of: what’s next? For investors just getting up to speed on the thesis, is this still a good time to buy? Or have prices gone up too much?

To answer these questions, let’s first look at what’s been happening in the spot market. When Sprott first started buying pounds, they could source a bunch from trading houses such as THK (Kazatomprom’s trading house), Traxys, Rio and other traders that were willing to flip their inventory for a decent profit. But as Sprott continues to buy, the market is quickly thinning out. Spot uranium is a very illiquid market to begin with, and with Sprott having publicly announced its intention to raise another $1bn, many potential sellers (esp those who have been waiting for years for a uranium bull market) are going to hold out for higher prices.

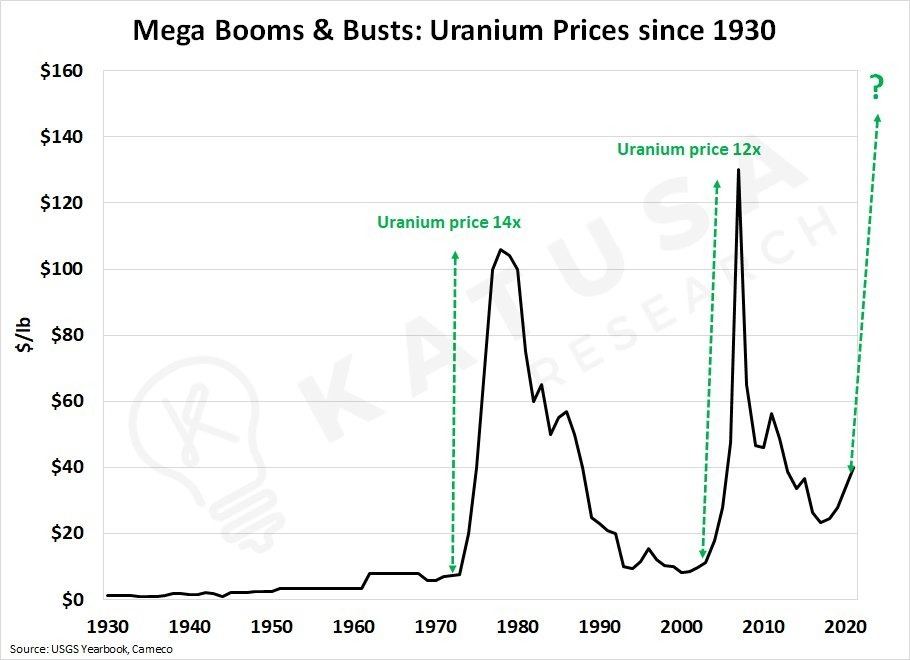

Given the unprecedented nature of what’s happening , I don’t think anyone knows for certain how this will all play out. For example, it’s hard to figure out how much spot inventory is out there and at what price it would transact. I think a likely scenario is that as the spot market dries up, Sprott will keep lifting its bids in an attempt to get fills on its orders and this will cause the spot price to ‘gap up’. Just a couple of days ago I noticed the price gap up almost $3.50 / lb in one day to $49 / lb. As the market thins out, these gaps are going to get larger and larger. Eventually a spot price in the triple digits isn’t out of the question, and not without historical precedent:

This type of price action will attract more momentum buyers and Sprott will be able to continue raising capital until the spot market completely runs out. At what price will that happen? Will it be $100 / lb? $200? I don’t think there is a great answer to that question, but it’s clear that we’re still in the early stages of this playing out given the amount of capital Sprott still has to deploy, the fact that mainstream financial media is only now picking up the story and that history suggests uranium prices can go much higher.

Given that spot prices can easily more than double from here, simply buying the Sprott Trust (U.UN) is a great way of playing this trade if you don’t want to bet on a specific management team / equity story. You should keep a track of capital raised (shares issued), capital deployed and spot price moves in relation to the two. You also need to keep an eye on the premium to NAV, as a very high premium could mean you are overpaying for the fund’s current assets. In some cases a premium to NAV may be justified. For example the premium to NAV jumped to almost 30% after Sprott filed for the renewed ATM. The large premium resulted from the fact that Sprott had to take a 3 day pause from issuing more shares and buying more pounds, but the market had already priced in the news of the $1bn addition ATM and it’s likely impact on the spot price.

When Sprott runs out of pounds to purchase, the ATM issuance will slow down and Sprott will probably indicate publicly that they are having trouble sourcing more pounds to acquire. What happens to spot price at that point is anyone’s guess. Some have argued that with supply completely inelastic over the next 12m (Cameco and KAP’s shut-in production will take at least 12 – 24 months to come back on), the spot price bids could reach ridiculous levels ($300 / $700 / $1000?!). But these levels will be meaningless as there will be no supply to fill the orders. The utilities will be scrambling to sign new contracts with the miners but given the huge supply / demand deficit, a lot of utility demand could remain uncovered. The signing of new long-term contracts at higher prices will be a major milestone for uranium equities and could lift the stock prices of the miners up manifold.

I had a chart in my first write-up that showed Chinese nuclear output quadrupling by 2035. One of the executives at Kazatomprom said last year that the world will need two more Kazatomproms by then. In their most recent presentation they even sent a warning to utilities about supply shortages:

Tim Gitzel, CEO of Cameco, is on record saying that the world will need six McArthur Rivers or Cigar Lakes (two of the largest uranium mines) by then. The increase in spot prices from Sprott’s entry into the market might appear to be rapid and unsustainable to investors today, but if we look at the long term supply and demand trajectory for uranium, I think we’re still very early in the cycle.

That being said anytime an asset class has a parabolic move up, volatility tends to blow out and you get both sharp upside moves and corrections. It could be that in the next 6-12 months some of the gains in uranium equities we’re seeing today are given back.

My recommendation to investors entering the thesis now is three-fold:

1/ deploy only 1/3rd or 1/4th of your capital in one go, allowing you to dollar cost average / take advantage of dips

2/ have a buy and hold portfolio to play the longer term (3-5+ year) structural deficit in the uranium market as well as a ‘trading’ portfolio to take advantage of the parabolic moves we’re seeing right now, knowing that a lot of these gains might be given back as momentum chasers / traders / speculators move in and out of the space and using stop losses to lock-in profits and preserve capital during such draw downs

3/ know what you’re buying when you’re investing in specific miners / equities – make sure to due diligence the company’s reserves / assets, cost structure, capital allocation policies and contracts; if you don’t have time to do all of that then stick to buying broad based ETFs or just the physical trusts / ETFs for pure commodity exposure.

Conclusion

The world is in the midst of a major energy revolution / transition that’s going to play out over many years, even decades. So while the moves in the uranium sector over the past few months might seem drastic, I believe we’re only getting started. To put things into perspective the entire uranium sector, which fuels ~11% of the world’s electricity (and is the only reliable baseload power source that is emissions free), is $<$50bn in value. Compare that to a company like Tesla which is ~$750bn in market cap and produces electric vehicles in an increasingly competitive market which represent only 1% of the car fleet and a product that is not really ESG friendly (more on that later)! So if you’re wondering whether it’s too late to get involved in the uranium sector and whether valuations are already too high, the answer is ‘no’. The upside potential for the sector in terms of capital inflows over the next few years is simply enormous. The story is just getting out. Uranium equities could be part of the next generation of ‘growth stocks’.

Gear Energy Update

It’s been a while since I wrote a focus article on Gear (GXE.TO). There haven’t been any big surprises, and focusing on the oil market / macro has been far more important given the impacts of COVID, the OPEC+ agreements and the constantly changing oil demand outlook in the short to medium term. Gear (and energy equities in general) will remain volatile until investors can feel confident that higher oil prices are here to stay and therefore keeping an eye on the constantly evolving oil supply / demand fundamentals is probably the best use of time for anyone invested in the space. Regardless, there are a couple of important company-specific developments to to talk about so let’s get into it.

In my last post I had surmised that the Company’s convertible debentures were likely to get exchanged for new debentures given the November 2020 maturity date and the limited cash on hand / liquidity available to pay back the principal (C$13.2mm). In December the Company announced that it had exchanged the debentures for new debentures, extending the maturity to 2023 and reducing the conversion price from C$0.87 to C$0.32 (representing a roughly 20% premium to the stock price at the time). This was highly dilutive as the underlying shares increased almost three-fold from ~15mm (~7% of shares outstanding) to ~41mm (~17% of shares outstanding). Interest expense was also renegotiated higher from 4% to 7%. In the market environment at the time capital access had all but dried up for energy companies, so there was no other alternative but to accept this deal and hope that future cash flows would allow Gear to mop-up the excess share count / dilution created from the deal.

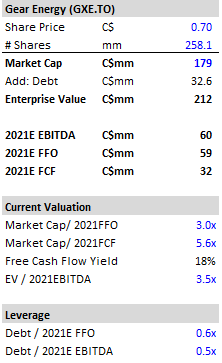

After executing this transaction, the share price quickly rose above the C$0.32 conversion price causing some investors to exercise their early conversion right and take delivery of the underlying shares. On March 16, 2021, with the stock trading at close to C$0.50, Gear announced early redemption on the remaining / unconverted portion of the debentures of around C$12.7mm. This meant issuing almost 40mm additional shares, but the company would be saving C$900K on interest expense annually (7% interest rate x C$12.7) or C$0.45 / boe. The company’s current share count is ~258mm and debt is now ~C$33mm, down from ~C$70mm in Q2 2020. The reduction in debt is through a combination of converting the debentures (C$13.2mm principal) and paying down the credit lines using excess cash flows (C$~24mm).

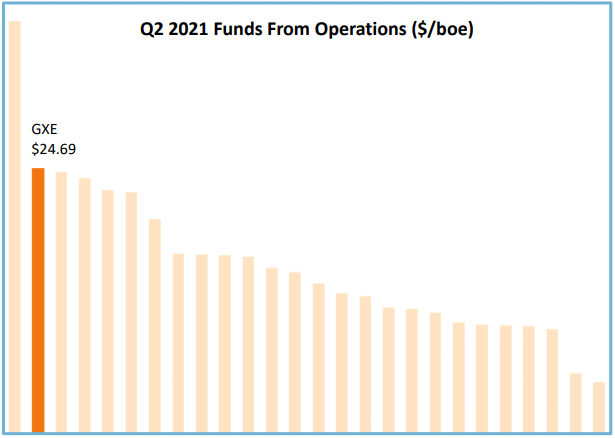

Throughout this timeframe Gear has maintained its exceptional cost discipline allowing it to de-leverage quickly and targeting to be debt-free by the end of the year or by Q1 2022 (oil prices permitting). On July 29, 2021 the Company announced Q2 2021 results showing that it generated C$12.2mm in Funds-from-Operations (FFO) for the quarter (C$24.69 per boe), putting it in the top 2 companies in its peer set (see the most recent investor presentation for peer set details):

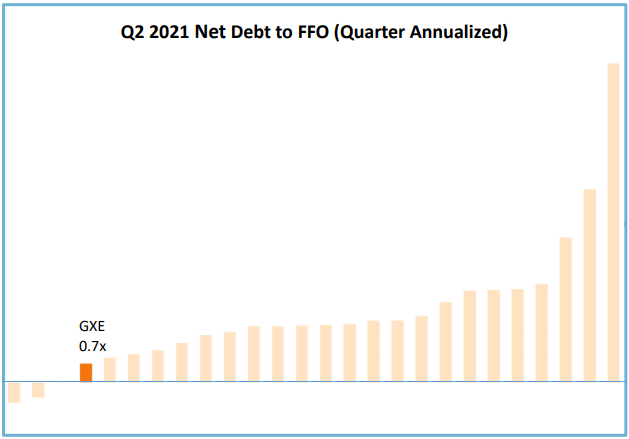

Comparing the current outstanding debt to the FFO (quarter annualized) shows that Gear is also in the top 4 in its peer set from a leverage perspective:

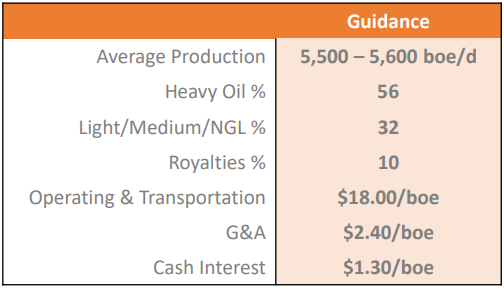

Based on Gear’s monthly reports the Company has generated C$26mm in FFO year-to-date (ending July 2021), spent C$19mm in capital and abandonment expenditures and produced an average of 5,448 boe/d. Keep in mind that capital expenditures are weighted more towards the beginning of the year. There is only an additional C$7-8mm of capital expenditures to be spent for the rest of the year which means that debt pay down should accelerate into Q3 – Q4 (again, assuming oil prices remain supportive).

If we annualize the FFO generated YTD we can expect Gear to generate roughly C$4mm per month or C$20mm for the rest of the year (August to December). If we deduct C$8mm of capital expenditures remaining under this year’s program that leaves us with C$12mm of excess free cash flow available for debt reduction and a YE debt balance of around C$21mm. This is a conservative estimate as WTI averaged US$63.45 from January to July 2021 and is currently closer to US$70, but the point of the analysis is to confirm that the Company remains within spitting distance of being debt-free in the coming quarters. Once the debt is paid off, Gear can then focus towards returning capital to shareholders in the form of share buyback and / or dividends.

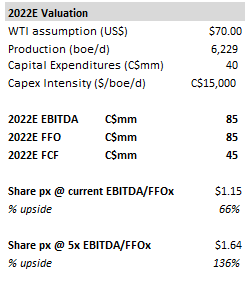

From a valuation perspective the stock remains incredibly cheap relative to cash flow reflecting the long-standing investor skepticism with regards to the sustainability of high oil prices.

Note: These figures don’t include the impact of hedging which is why they don’t tie with the Company’s FFO sensitivities in their investor presentation and the stub period calculations I did earlier.

The above EBITDA and cash flow numbers were modeled based on the company’s current guidance and assuming oil prices remain flat to average price over 2021 year-to-date period ending July 2021.

If the world is finally able to control COVID and oil demand recovers to pre-2019 levels, then a US$70+ scenario is quite likely. In that case the valuation / price targets would look something like this:

While a 66% – 136% upside potential is nothing to sneeze at, after holding this stock for 6+ years and experiencing countless drawdowns / volatile periods the investment only going to be worth it from an annualized returns perspective if the stock price multiplies 3-4x from today’s price in the next couple of years. For that two things need to happen: 1/ oil prices need to enter a sustained bull market similar to the 2010 – 2014 era when oil price was consistently above US$80+ 2/ investors need re-embrace energy investing and be willing to apply multiples to E&P cash flows commensurate with what we have seen historically.

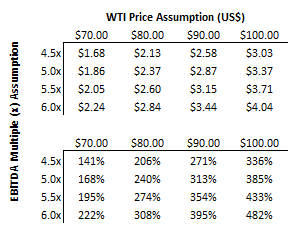

The above data table takes the same valuation methodology I applied for 2022E valuation and sensitizes it for 2023E valuation for these two key variables (oil price and valuations). I haven’t included the impact of share buy backs, nor have I incorporated the potential tightening of the WCS spread once the Trans Mountain pipeline comes into operation in 2022, so I consider these numbers to be conservative.

Conclusion

Gear management is doing everything under their control to make sure that the company is able to de-risk its balance sheet and remain the lowest cost operator in its peer set. This means that Gear remains an ideal vehicle to ride the bull market in oil, but it also means that I need to focus on getting the oil market fundamentals right and why most of my writing on the oil thesis will continue to be focused on the macro and supply / demand fundamental analysis.

After experiencing numerous set backs (Shale over-production, 2018 Saudi surge, 2019 trade war, 2020 COVID crash and Saudi / Russia price war) energy investors like myself have become a weary, worn-out bunch. But I feel the long-term bull thesis has kept on progressing unnoticed with the world creeping towards a structural supply deficit. The numbers in the data table above may look unrealistic today, but from where I sit, years of underinvestment in the sector are about to hit the oil markets all at once after OPEC+ runs out of spare capacity and the RoW finds it needs several years of new oil investments to get production growing sustainably again.

Investors today may seem pre-occupied with ESG as the latest investment fad, but at some point they will be forced to notice the incredible operating leverage and free cash flows energy companies can generate in the right pricing environment. At the current valuations Gear will be able to buy back it’s ENTIRE market cap using excess free cash flow in about 3 years if WTI prices sustained at US$80, or alternatively pay out a 30%+ dividend! Sure ESG is cool, but cash is king in the end.

Uranium Update

The recent sell-off in uranium equities has unnerved investors and generated doubts about the thesis. Based on my analysis of recent events however I feel the bearish price action has been more a function of positioning / technical factors vs. any fundamental changes.

What’s clear is that a number of retail traders / speculators with low conviction in the long-term thesis had been piling into the sector given the strong uptrend since December last year. You should always be wary when ‘momentum chasers’ start becoming involved in your favorite investments as they inevitably panic sell at the slightest hint of trouble.

The ‘trouble’ began on June 14 when CNN put out a story regarding a nuclear reactor located in Southern China.

To be fair, as a uranium investor this is last thing you want to see in the headlines. For more than a decade uranium investors have been scarred by the repercussions of the accident at Japan’s Fukushima reactors and any news that puts into doubt the safety aspects of nuclear energy rightly generates a ‘sell first, ask questions later’ mentality.

When I read this headline I instinctively sold out of 50% of my position as a risk management measure until I could understand the situation better. However it quickly became clear to me that this was not a significant incident and certainly not a threat to the long-term bull thesis. The International Atomic Energy Agency (“IAEA”) explained it best in their article three days later.

I would strongly encourage you to read the article in full and understand it for yourself. But the summary is that the CNN headline was very misleading. The reported ‘leak’ was simply an increase in radioactivity in the primary reactor at the facility (which sits inside a containment with several further barriers to prevent release into the environment) caused by a failure of fuel cladding, which is a known and not uncommon occurrence. The proportion of damaged fuel rods at the Taishan reactor was less than 0.01% of the total, much lower than the 0.25%threshold / margin of safety to account for uncontrollable factors. This what China’s National Nuclear Safety Administration had to say: “Due to the influence of uncontrollable factors such as fuel manufacturing, transportation, loading, etc., a small amount of fuel rod damage during the operation of nuclear power plants is unavoidable, which is a common phenomenon.”

Despite this relatively clear explanation uranium stocks have continued to sell-off, clearly demonstrating that a number of the investors / traders who have recently become involved in the sector have no interest in any fundamental analysis and are simply chasing price / momentum.

Now that we’ve gotten that out of the way – on to the more interesting stuff!

By far the most exciting development in the sector recently is the ‘financialization’ of uranium purchases. Two of the physical uranium trusts, Yellow Cake plc and Uranium Participation Corp. (UPC), have been joined by a number of pre-production companies in buying physical uranium from the spot market. It started in March of this year when Yellow Cake announced it had exercised its 2021 option to purchase 3.5mm pounds of U3O8 from Kazatomprom. To fund this purchase Yellow Cake went out to raise US$110mm in equity and ended up upsizing the deal to US$140mm given the strong demand / oversubscription. This was a very important signal to the community that investor sentiment had started to shift. It wasn’t just retail mom-pop investors anymore but institutional money coming in to bet on the revival of the sector in a big way.

This announcement triggered a number of other transactions from pre-production mining companies including Denison Mines, Boss Resources, Uranium Energy Corp. (UEC), Uranium Royalty Corp all purchasing pounds in the spot market. The buying of physical uranium by miners is quite unprecedented and reflects a high conviction bullish bet on future uranium prices. In addition to these purchases, Cameco and Kazatomprom have also been buying on the spot market to meet their contractual delivery agreements (due to mine closures / production curtailments). In total more than 21mm lbs of uranium have been taken off the spot market as a result of these purchases this year which is a significant percentage of the total demand estimated to be around ~180mm lbs.

On April 28th the market was rocked by another bombshell announcement: Uranium Participation Corp announced their decision to be acquired and managed by Sprott Asset Management. UPC would become the “Sprott Physical Uranium Trust” and join the family of Sprott physical commodity trusts like PSLV (Silver) and PHYS (Gold) that are extremely popular with commodity investors. The transaction was completed recently and the trust started trading under the ticker U.UN on July 19.

This is significant for a couple of reasons:

1/ Sprott is a marketing powerhouse for commodity ETFs (as evidenced by the size / AUM of their gold and silver ETFs)

2/ Sprott intends to obtain a U.S. listing for the trust which will materially broaden the investor base and

3/ the new trust will be able to raise capital through an At-The-Money (ATM) equity issuance structure which means capital inflows into the trust will lead to consistent / frequent purchases of physical uranium. In fact SPUT has already started buying on the spot market with 900K lbs purchase on August 20: