OPEC+

I consider OPEC+ to be far less of a risk compared to the Delta variant. While experience has shown that OPEC+ members can be a volatile / unpredictable bunch, I do believe in the power of economic and political incentives. Oil price volatility over the last couple of years has wreaked havoc on OPEC+ countries’ fiscal conditions and another price war could cause deep discontent and potential civil unrest in some member countries.

Saudi Arabia FX reserves (in SAR):

Saudi Arabia for example currently suffers from ~15% youth unemployment and has had to repeatedly defer investment programs to create new jobs and diversify their economy. The newly elected Democratic administration in the US has also signaled less friendly relations with the Saudis, increasing the pressure to maximize oil revenues.

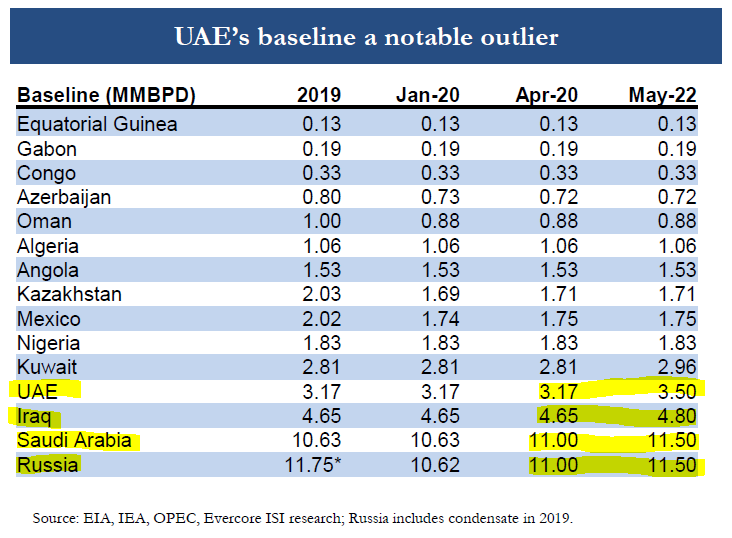

On July 18, OPEC+ members reached an agreement to extend their current round of production cuts through end-2022. The negotiations however took longer than expected (two weeks) and uncovered disagreements between Saudi Arabia and the UAE regarding the baselines used for calculating the production cuts.

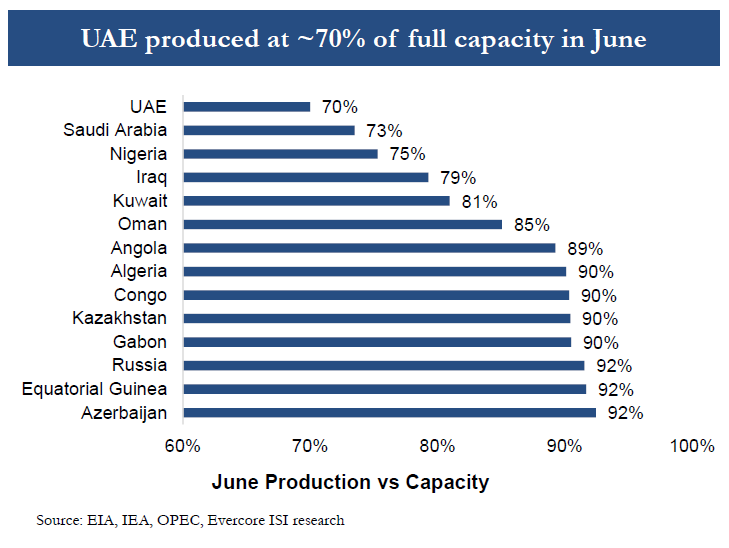

The current baseline for most OPEC members was set in April 2021 and was similar to production levels in 2019. Since then, most members’ productive capacities have remained constant if not declined due to underinvestment (Algeria, Angola and Nigeria), with the exception of the UAE. The UAE increased production capacity from 3.5 to 3.8 mm b/d and therefore argued that it was withholding more barrels from the market (as a % of its production capacity) vs. its peers.

OPEC+ members (most notably Iraq) pushed back against this arguing that the UAE should not be given special treatment. However the final agreement allowed for a number of countries (Kuwait, Iraq, UAE, Saudi Arabia and Russia) to increase their baseline to satisfy demands for equality:

A number of market observers took this to be a bearish development as it highlighted lack of unity amongst OPEC+ as well as higher production down the road as a result of the higher baselines. I disagree with this interpretation.

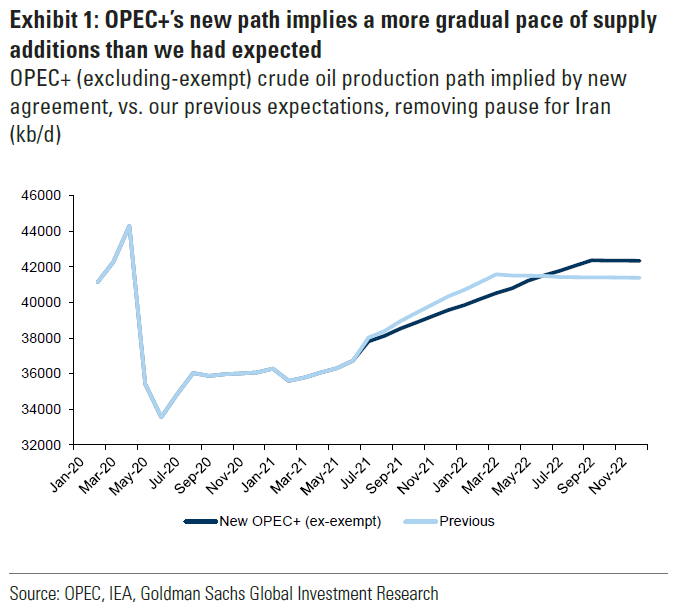

The first thing to remember is that baselines are not quotas. The group has agreed to increased production by 400K b/d from August to December which, based on current demand projections, guarantees a very tight oil market / deficit for the rest of the year. However the most bullish aspect of the deal in my opinion is the extension of the cuts to the end of 2022.

This new ramp up schedule into end-2022 is slower than what most energy / sell-side analysts were expecting. If oil demand recovers to 2019 levels and beyond (as most oil analysts expect by next year), the continued production curtailments virtually guarantee sustained high oil prices into next year as well! So while the increase in baselines is higher than expected, it is not bearish as it does not impact production volumes set by quotas for this year and 2022.

While OPEC+ has signaled that they are willing to keep market conditions tight, the increase in headline spare capacity / baseline also disincentivizes competing investments (for example US Shale) and leads to sustainable backwardation of the oil futures curve. This is a goldilocks scenario for the oil bulls: spot oil prices remain high, while the threat of future spare capacity prevents non-OPEC+ oil producers from investing in supply.

Finally, there is also the question of whether the increase in baselines reflects production reality or whether these numbers are more a means of posturing / jaw-boning. While the increase in UAE’s production capacity appears to be ‘real’, a number of independent observers are skeptical whether Saudi Arabia can really produce at 11.5 mm b/d day for an extended period. Russia as well seems to have struggled with maintaining its current production levels so an increase in the baseline by 500k b/d seems like an overly optimistic assessment of their production capacity:

Conclusion: While the disagreements between UAE and the rest of OPEC+ were initially perceived to be bearish, it appears from the final agreement and press comments that OPEC+ is united and committed to maintaining supply discipline over the longer-term. This makes sense given the weak economic conditions faced by OPEC+ countries as well as waning political support for Saudi Arabia from the US government (which removes any incentive for Saudi Arabia to maintain low prices to benefit the US consumer).

Finally, by increasing baselines the group has shrewdly signaled the ability to raise production significantly when needed (whether this capacity is ‘real’ or not can be debated), leading to an ideal scenario for oil bulls where spot price will likely remain elevated but future supply investments will be disincentivized giving OPEC+ more control over the market.