It’s been a while since I wrote a focus article on Gear (GXE.TO). There haven’t been any big surprises, and focusing on the oil market / macro has been far more important given the impacts of COVID, the OPEC+ agreements and the constantly changing oil demand outlook in the short to medium term. Gear (and energy equities in general) will remain volatile until investors can feel confident that higher oil prices are here to stay and therefore keeping an eye on the constantly evolving oil supply / demand fundamentals is probably the best use of time for anyone invested in the space. Regardless, there are a couple of important company-specific developments to to talk about so let’s get into it.

In my last post I had surmised that the Company’s convertible debentures were likely to get exchanged for new debentures given the November 2020 maturity date and the limited cash on hand / liquidity available to pay back the principal (C$13.2mm). In December the Company announced that it had exchanged the debentures for new debentures, extending the maturity to 2023 and reducing the conversion price from C$0.87 to C$0.32 (representing a roughly 20% premium to the stock price at the time). This was highly dilutive as the underlying shares increased almost three-fold from ~15mm (~7% of shares outstanding) to ~41mm (~17% of shares outstanding). Interest expense was also renegotiated higher from 4% to 7%. In the market environment at the time capital access had all but dried up for energy companies, so there was no other alternative but to accept this deal and hope that future cash flows would allow Gear to mop-up the excess share count / dilution created from the deal.

After executing this transaction, the share price quickly rose above the C$0.32 conversion price causing some investors to exercise their early conversion right and take delivery of the underlying shares. On March 16, 2021, with the stock trading at close to C$0.50, Gear announced early redemption on the remaining / unconverted portion of the debentures of around C$12.7mm. This meant issuing almost 40mm additional shares, but the company would be saving C$900K on interest expense annually (7% interest rate x C$12.7) or C$0.45 / boe. The company’s current share count is ~258mm and debt is now ~C$33mm, down from ~C$70mm in Q2 2020. The reduction in debt is through a combination of converting the debentures (C$13.2mm principal) and paying down the credit lines using excess cash flows (C$~24mm).

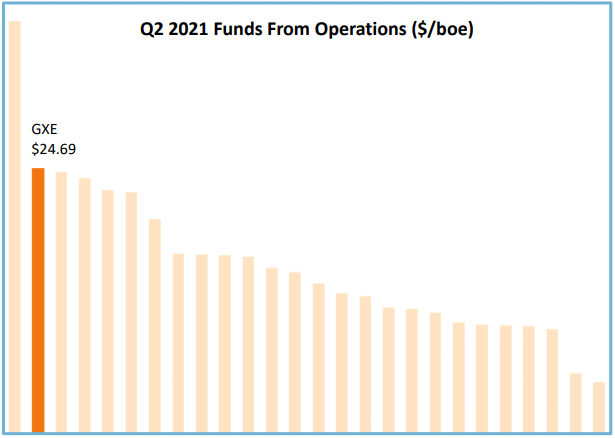

Throughout this timeframe Gear has maintained its exceptional cost discipline allowing it to de-leverage quickly and targeting to be debt-free by the end of the year or by Q1 2022 (oil prices permitting). On July 29, 2021 the Company announced Q2 2021 results showing that it generated C$12.2mm in Funds-from-Operations (FFO) for the quarter (C$24.69 per boe), putting it in the top 2 companies in its peer set (see the most recent investor presentation for peer set details):

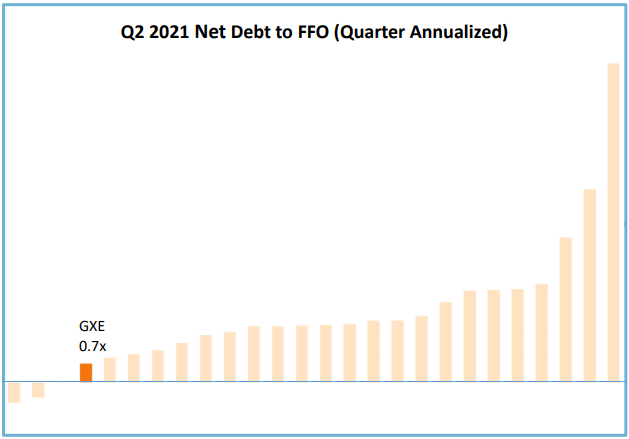

Comparing the current outstanding debt to the FFO (quarter annualized) shows that Gear is also in the top 4 in its peer set from a leverage perspective:

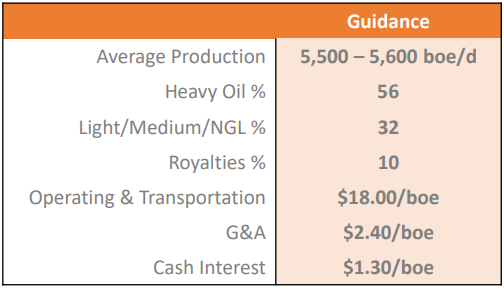

Based on Gear’s monthly reports the Company has generated C$26mm in FFO year-to-date (ending July 2021), spent C$19mm in capital and abandonment expenditures and produced an average of 5,448 boe/d. Keep in mind that capital expenditures are weighted more towards the beginning of the year. There is only an additional C$7-8mm of capital expenditures to be spent for the rest of the year which means that debt pay down should accelerate into Q3 – Q4 (again, assuming oil prices remain supportive).

If we annualize the FFO generated YTD we can expect Gear to generate roughly C$4mm per month or C$20mm for the rest of the year (August to December). If we deduct C$8mm of capital expenditures remaining under this year’s program that leaves us with C$12mm of excess free cash flow available for debt reduction and a YE debt balance of around C$21mm. This is a conservative estimate as WTI averaged US$63.45 from January to July 2021 and is currently closer to US$70, but the point of the analysis is to confirm that the Company remains within spitting distance of being debt-free in the coming quarters. Once the debt is paid off, Gear can then focus towards returning capital to shareholders in the form of share buyback and / or dividends.

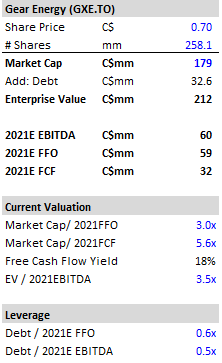

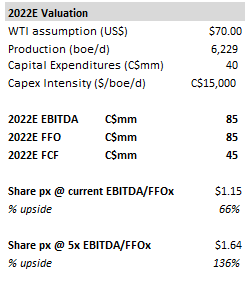

From a valuation perspective the stock remains incredibly cheap relative to cash flow reflecting the long-standing investor skepticism with regards to the sustainability of high oil prices.

Note: These figures don’t include the impact of hedging which is why they don’t tie with the Company’s FFO sensitivities in their investor presentation and the stub period calculations I did earlier.

The above EBITDA and cash flow numbers were modeled based on the company’s current guidance and assuming oil prices remain flat to average price over 2021 year-to-date period ending July 2021.

If the world is finally able to control COVID and oil demand recovers to pre-2019 levels, then a US$70+ scenario is quite likely. In that case the valuation / price targets would look something like this:

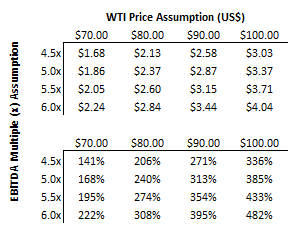

While a 66% – 136% upside potential is nothing to sneeze at, after holding this stock for 6+ years and experiencing countless drawdowns / volatile periods the investment only going to be worth it from an annualized returns perspective if the stock price multiplies 3-4x from today’s price in the next couple of years. For that two things need to happen: 1/ oil prices need to enter a sustained bull market similar to the 2010 – 2014 era when oil price was consistently above US$80+ 2/ investors need re-embrace energy investing and be willing to apply multiples to E&P cash flows commensurate with what we have seen historically.

The above data table takes the same valuation methodology I applied for 2022E valuation and sensitizes it for 2023E valuation for these two key variables (oil price and valuations). I haven’t included the impact of share buy backs, nor have I incorporated the potential tightening of the WCS spread once the Trans Mountain pipeline comes into operation in 2022, so I consider these numbers to be conservative.

Conclusion

Gear management is doing everything under their control to make sure that the company is able to de-risk its balance sheet and remain the lowest cost operator in its peer set. This means that Gear remains an ideal vehicle to ride the bull market in oil, but it also means that I need to focus on getting the oil market fundamentals right and why most of my writing on the oil thesis will continue to be focused on the macro and supply / demand fundamental analysis.

After experiencing numerous set backs (Shale over-production, 2018 Saudi surge, 2019 trade war, 2020 COVID crash and Saudi / Russia price war) energy investors like myself have become a weary, worn-out bunch. But I feel the long-term bull thesis has kept on progressing unnoticed with the world creeping towards a structural supply deficit. The numbers in the data table above may look unrealistic today, but from where I sit, years of underinvestment in the sector are about to hit the oil markets all at once after OPEC+ runs out of spare capacity and the RoW finds it needs several years of new oil investments to get production growing sustainably again.

Investors today may seem pre-occupied with ESG as the latest investment fad, but at some point they will be forced to notice the incredible operating leverage and free cash flows energy companies can generate in the right pricing environment. At the current valuations Gear will be able to buy back it’s ENTIRE market cap using excess free cash flow in about 3 years if WTI prices sustained at US$80, or alternatively pay out a 30%+ dividend! Sure ESG is cool, but cash is king in the end.