On August 22nd, I wrote a uranium update concluding that investors should be buying the dip in uranium equities and that Sprott’s entrance into the market would be a game changing catalyst for the thesis. I wrote:

“All these developments can significantly accelerate the balancing of the uranium market as they increase the financial demand for uranium (in addition to the step change in physical demand that’s about to occur over the next few years as I elaborated on in my first article). We could potentially see a positive feedback loop where buying from the Sprott uranium trust leads to an increase in spot price, which in turn leads to more inflows for the trust from momentum chasing hedge funds / investors, which then leads to even more buying.“

My timing couldn’t have been better. The very next day uranium equities started shooting up on the news that on August 20th the Sprott Physical Trust (SPUT) had purchased 600K lbs of uranium, in addition to the 300K pounds they acquired on August 19th (the first day of purchases). Just to give you a sense of what these quantities mean, a standard 1GW nuclear reactor requires 450K lbs of uranium a year. So within 2 days SPUT had taken in the equivalent of annual uranium supply for two nuclear reactors!

Given the strong demand / inflows Sprott started to quickly run out of room on the At-the-money (ATM) equity facility they had originally filed. On September 9th, with almost $250mm of capital raised (~80% of the original $300mm ATM size) and nearly 7mm lbs of uranium acquired, Sprott filed an update to the ATM facility, upsizing it from $300mm to $1.3bn! The news sent shockwaves through the uranium investing community and created a buying frenzy in uranium stocks.

The $250mm+ of purchases up to that point had pushed spot prices from ~$30 to $40 / lb. An additional $1bn was a recipe for a squeeze, and a wake up call for the utilities who had apparently been calling Sprott to ask what was going on (they are clearly far behind the curve). Spot price today is just inching above $50 / lb, a level many had never imagined seeing this year and the highest level in almost a decade!

If you had bought long positions in the sector on August 23rd, the returns have been impressive:

URNM +68.1%

URA +43.6%

U.UN (Sprott Trust) +50.2%

However this does raise the question of: what’s next? For investors just getting up to speed on the thesis, is this still a good time to buy? Or have prices gone up too much?

To answer these questions, let’s first look at what’s been happening in the spot market. When Sprott first started buying pounds, they could source a bunch from trading houses such as THK (Kazatomprom’s trading house), Traxys, Rio and other traders that were willing to flip their inventory for a decent profit. But as Sprott continues to buy, the market is quickly thinning out. Spot uranium is a very illiquid market to begin with, and with Sprott having publicly announced its intention to raise another $1bn, many potential sellers (esp those who have been waiting for years for a uranium bull market) are going to hold out for higher prices.

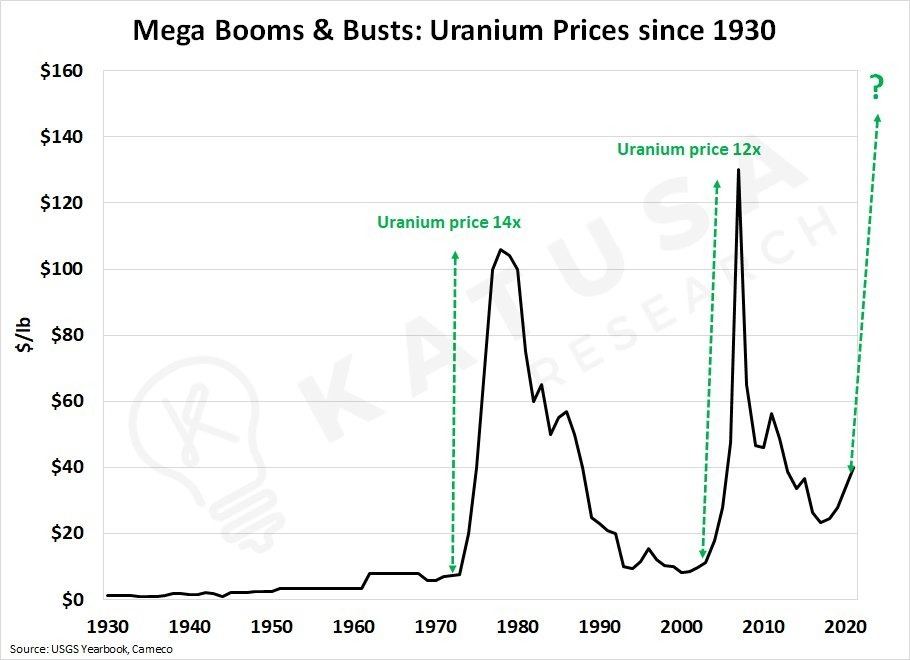

Given the unprecedented nature of what’s happening , I don’t think anyone knows for certain how this will all play out. For example, it’s hard to figure out how much spot inventory is out there and at what price it would transact. I think a likely scenario is that as the spot market dries up, Sprott will keep lifting its bids in an attempt to get fills on its orders and this will cause the spot price to ‘gap up’. Just a couple of days ago I noticed the price gap up almost $3.50 / lb in one day to $49 / lb. As the market thins out, these gaps are going to get larger and larger. Eventually a spot price in the triple digits isn’t out of the question, and not without historical precedent:

This type of price action will attract more momentum buyers and Sprott will be able to continue raising capital until the spot market completely runs out. At what price will that happen? Will it be $100 / lb? $200? I don’t think there is a great answer to that question, but it’s clear that we’re still in the early stages of this playing out given the amount of capital Sprott still has to deploy, the fact that mainstream financial media is only now picking up the story and that history suggests uranium prices can go much higher.

Given that spot prices can easily more than double from here, simply buying the Sprott Trust (U.UN) is a great way of playing this trade if you don’t want to bet on a specific management team / equity story. You should keep a track of capital raised (shares issued), capital deployed and spot price moves in relation to the two. You also need to keep an eye on the premium to NAV, as a very high premium could mean you are overpaying for the fund’s current assets. In some cases a premium to NAV may be justified. For example the premium to NAV jumped to almost 30% after Sprott filed for the renewed ATM. The large premium resulted from the fact that Sprott had to take a 3 day pause from issuing more shares and buying more pounds, but the market had already priced in the news of the $1bn addition ATM and it’s likely impact on the spot price.

When Sprott runs out of pounds to purchase, the ATM issuance will slow down and Sprott will probably indicate publicly that they are having trouble sourcing more pounds to acquire. What happens to spot price at that point is anyone’s guess. Some have argued that with supply completely inelastic over the next 12m (Cameco and KAP’s shut-in production will take at least 12 – 24 months to come back on), the spot price bids could reach ridiculous levels ($300 / $700 / $1000?!). But these levels will be meaningless as there will be no supply to fill the orders. The utilities will be scrambling to sign new contracts with the miners but given the huge supply / demand deficit, a lot of utility demand could remain uncovered. The signing of new long-term contracts at higher prices will be a major milestone for uranium equities and could lift the stock prices of the miners up manifold.

I had a chart in my first write-up that showed Chinese nuclear output quadrupling by 2035. One of the executives at Kazatomprom said last year that the world will need two more Kazatomproms by then. In their most recent presentation they even sent a warning to utilities about supply shortages:

Tim Gitzel, CEO of Cameco, is on record saying that the world will need six McArthur Rivers or Cigar Lakes (two of the largest uranium mines) by then. The increase in spot prices from Sprott’s entry into the market might appear to be rapid and unsustainable to investors today, but if we look at the long term supply and demand trajectory for uranium, I think we’re still very early in the cycle.

That being said anytime an asset class has a parabolic move up, volatility tends to blow out and you get both sharp upside moves and corrections. It could be that in the next 6-12 months some of the gains in uranium equities we’re seeing today are given back.

My recommendation to investors entering the thesis now is three-fold:

1/ deploy only 1/3rd or 1/4th of your capital in one go, allowing you to dollar cost average / take advantage of dips

2/ have a buy and hold portfolio to play the longer term (3-5+ year) structural deficit in the uranium market as well as a ‘trading’ portfolio to take advantage of the parabolic moves we’re seeing right now, knowing that a lot of these gains might be given back as momentum chasers / traders / speculators move in and out of the space and using stop losses to lock-in profits and preserve capital during such draw downs

3/ know what you’re buying when you’re investing in specific miners / equities – make sure to due diligence the company’s reserves / assets, cost structure, capital allocation policies and contracts; if you don’t have time to do all of that then stick to buying broad based ETFs or just the physical trusts / ETFs for pure commodity exposure.

Conclusion

The world is in the midst of a major energy revolution / transition that’s going to play out over many years, even decades. So while the moves in the uranium sector over the past few months might seem drastic, I believe we’re only getting started. To put things into perspective the entire uranium sector, which fuels ~11% of the world’s electricity (and is the only reliable baseload power source that is emissions free), is $<$50bn in value. Compare that to a company like Tesla which is ~$750bn in market cap and produces electric vehicles in an increasingly competitive market which represent only 1% of the car fleet and a product that is not really ESG friendly (more on that later)! So if you’re wondering whether it’s too late to get involved in the uranium sector and whether valuations are already too high, the answer is ‘no’. The upside potential for the sector in terms of capital inflows over the next few years is simply enormous. The story is just getting out. Uranium equities could be part of the next generation of ‘growth stocks’.