In July I wrote a three part update on the risks facing the oil markets and why it was prudent to de-leverage oil / energy positions until the outcome of the Delta variant wave had become a bit clearer. Since then, there have been a number of positive signs indicating that the worst might be behind us:

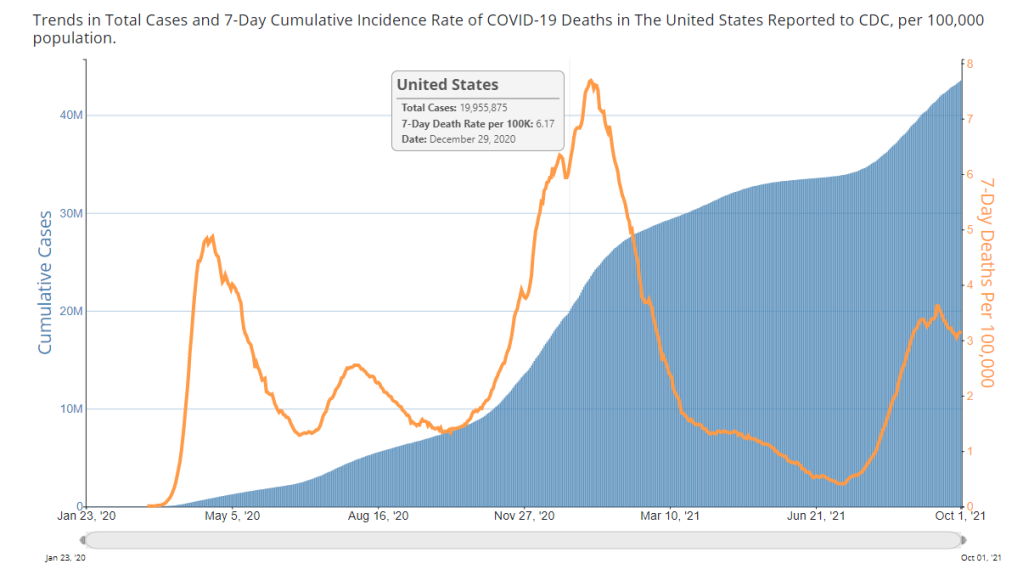

1/ Deaths have continued to be extremely low relative to cases in the United States, indicating that the vaccines are working and / or hospitals have become better at treating the disease.

The blue bars in the chart (left axis) above represent the cumulative total COVID cases in the US to-date while the orange line (right axis) represents 7-day average deaths per 100K people. The trend shows clearly that the current wave is a lot less deadly that the prior waves in 2020.

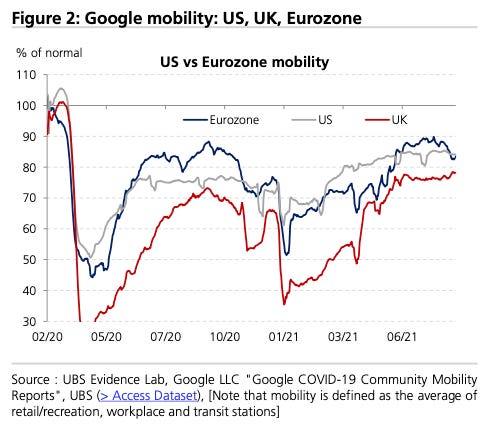

2/ Mobility has remained largely flat in the developed world over the last few months indicating that the era of lockdowns is coming to an end. It appears that both governments and the private sector are eager to continue on the road of normalization and don’t want to be held back in a ‘pandemic of the unvaccinated’.

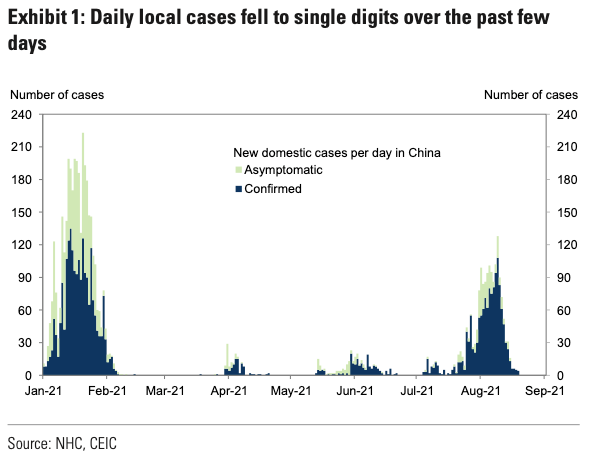

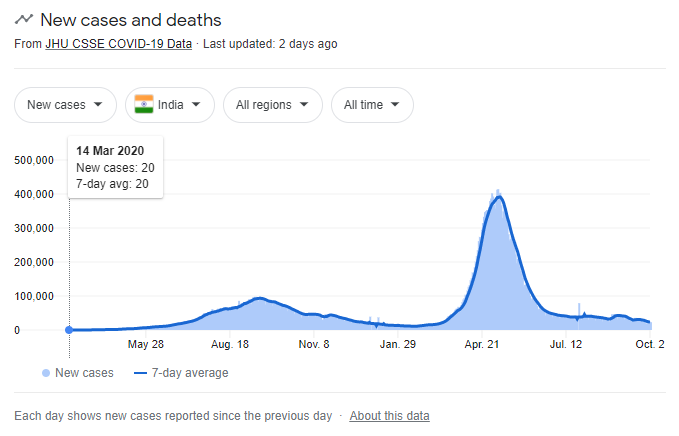

3/ Trends in Asia also continue to be positive with both China and India showing no signs of a major resurgence in cases.

China has continued with its ‘no tolerance’ policy and managed to clamp down on any potential waves with short but strict lockdown measures, while India has also continued to experience very low case counts due to a combination of herd immunity and rising vaccination rates.

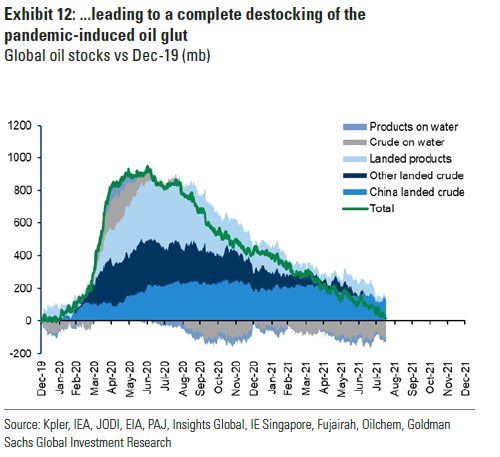

As a result of the above, the oil market has remained in a deep deficit with demand tracking at 98mm b/d and inventories continuing to draw strongly. Based on the latest global inventory data from Goldman Sachs the entire glut of oil inventory built over the pandemic era has been drained and the market is still in a 4mm b/d+ deficit (!).

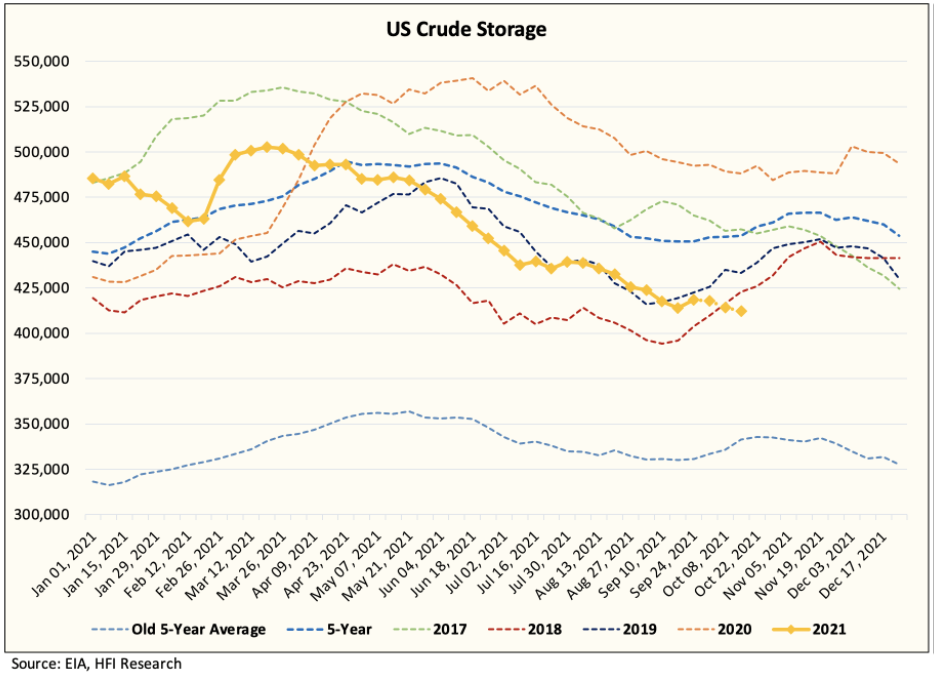

In the US, oil inventories are the lowest they’ve been in 5+ years with Hurricane Ida further accelerating oil storage drawdown with a 30mm bbls hit to storage and an ongoing 300K bbl / d production impact into year-end:

Last but not least (on the demand front), the global natural gas / energy crisis is likely to put additional pressure on oil demand this winter as a result of gas-to-oil switching. Global gas prices are currently trading US$180 / bbl on an oil-equivalent basis making oil the cheapest fossil fuel around. Most analysts estimate that gas-to-oil switching can lead to anywhere from 200K b/d to 1mm b/d additional oil demand in the coming months, depending on the severity of the winter season. At the higher end of the estimate (+1mm b/d, in a colder than normal winter scenario) an oil price in the triple digits is not out of question unless OPEC+ intervenes.

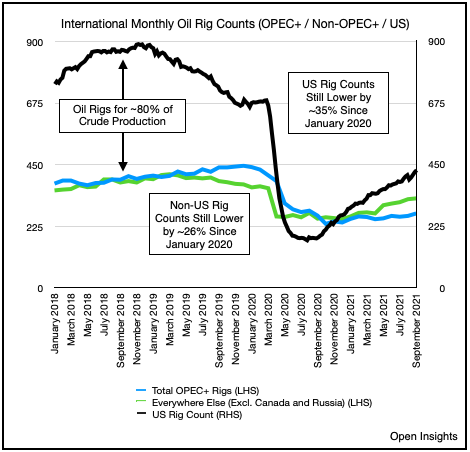

Turning to the supply side, rig counts, company statements / guidance and other data continue to suggest that supply is going to be a lot more inelastic this cycle vs. prior years.

While US rig counts are inflecting higher, accelerating decline rates, deteriorating productivity and renewed commitments to return capital to shareholders are going to prevent any meaningful increase in US output in the near to medium term.

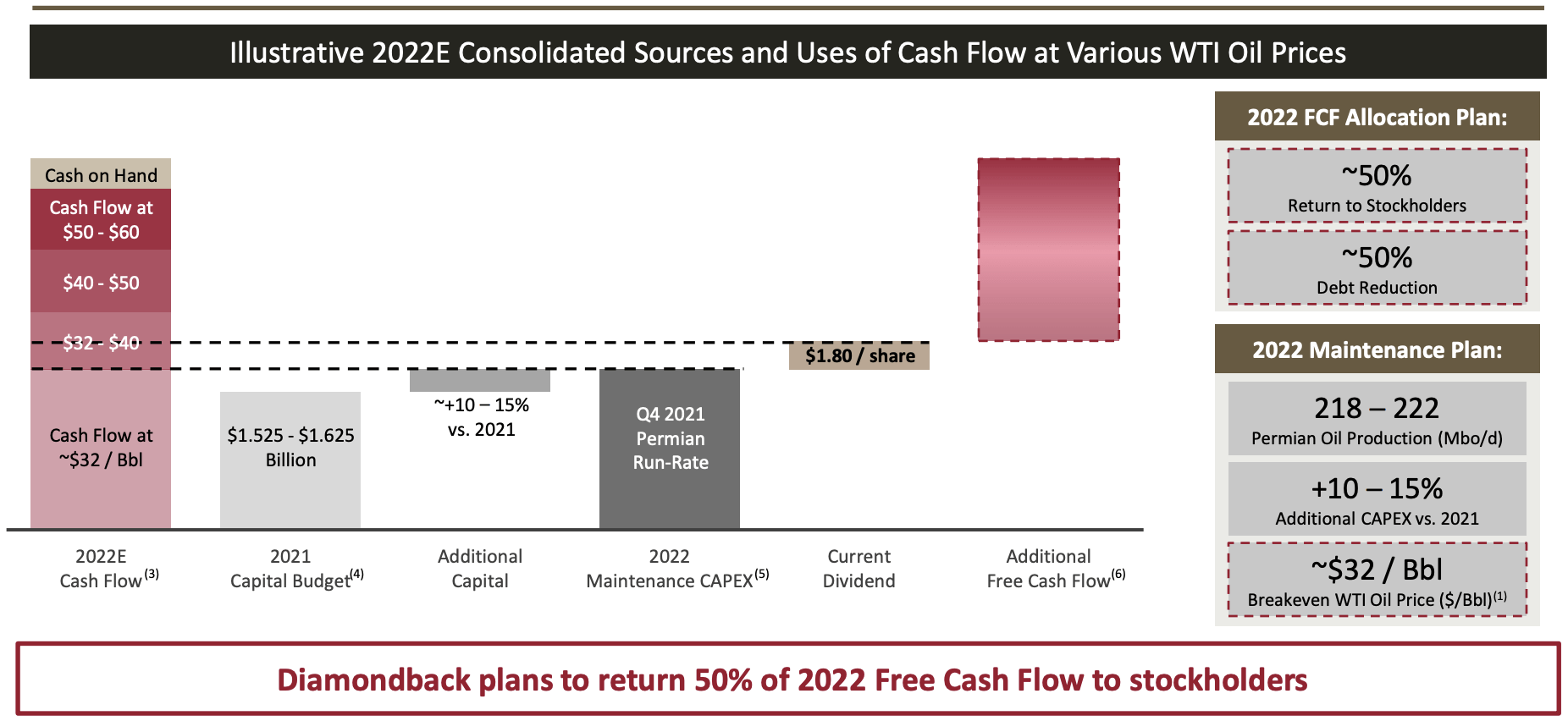

In a recent announcement one of the largest US oil producers (historically famous for its ‘grow at all costs’ strategy), Diamondback Energy, reiterated its commitment to return 50% of its free cash flow to shareholders:

Expect more US companies to follow suit as a combination of shareholder frustration with lack of capital returns and ESG mandates stymie any growth plans. The days of spending >100% of cash flow on production growth are over. Production growth of 3-5% is the new normal. With US production trending at roughly 11.5mm b/d, this equates to around ~600K b/d of supply growth which is not nearly enough to cure the 4mm b/d+ current deficit.

That leaves us with OPEC+. OPEC+ currently has 3-4mm b/d spare capacity. They have committed to increase production by 400K b/d each month going into 2022. If they feel pressured, they might increase this to 800K b/d, but they are unlikely to use up a more significant proportion of their spare capacity at this stage for a couple of reasons:

1/ After experiencing more than half a decade of low / volatile oil prices their fiscal budgets and balance sheets badly need higher oil prices for longer

2/ With Trump out of the office and Biden pursuing better relations with Iran, Saudi Arabia is a lot less incentivized to appease US concerns regarding high energy prices

3/ Increasing production pre-emptively may backfire if the winter turns out to be warmer than normal and the forecasted oil demand increase doesn’t materialize; this could be further compounded if there is a renewed COVID wave

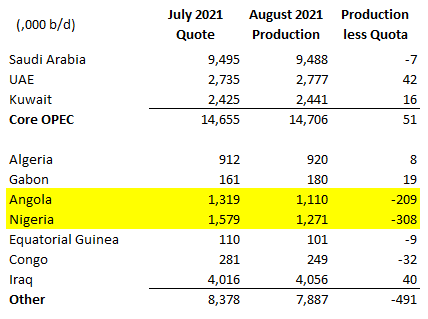

4/ OPEC+ production data continues to support the hypothesis that a couple of members don’t have the financial resources necessary to increase production and / or years of underinvestment in capex is starting to have its impact in the form of accelerating decline rates. Every member is incentivized to produce at quota to maximize revenues, however for several months a couple of OPEC+ members have continued to produce significantly below quota:

While countries like Saudi Arabia are known to have unilaterally cut production to support the oil markets in times of crises, it’s hard to imagine poor countries like Angola and Nigeria holding back production relative to quota out of the goodness of their hearts to benefit other oil producing nations. In Part III of my last oil market update I had also written about Russia’s struggle to increase oil production. All of this means that OPEC+’s actual spare capacity could be significantly lower than the ‘nameplate’ capacity which would argue for OPEC+ being more conservative about using up the remaining capacity.

Conclusion

The oil market headwinds I had written about in my last update are starting to lift. WTI has recaptured the critical $70+ level and energy stocks have also moved back up with XOP testing the key $100 level once again. With the world going into winter season facing an energy crisis as a result of natural gas shortages, there is a chance for an oil price spike which could lead to oil prices in the triple digits. While this would be great for a short-term gains, it would likely lead to a global recession and temper oil demand growth going into 2022.

I have positioned myself back to being fully long energy stocks. My playbook is to watch weather models carefully and observe how the markets are pricing winter weather risk. If we do get a colder than normal winter and a squeeze in oil prices, I might consider taking profits as such an exponential rise in energy prices will not be sustainable. If we don’t get a winter squeeze I believe oil prices will remain well supported in the $70-$75 / bbl range as the post-pandemic oil demand recovery will continue, and oil equities will continue to re-rate higher on a more steady basis given the tremendous cash flows and return on capital that will be possible. It goes without saying that keeping an eye out for COVID case counts globally, new variants and other COVID related tail risks is also going to be paramount. I’m keeping my head on a swivel and not getting ‘married’ to any of my trading positions.