In May 2020 I wrote a piece titled “Portfolio Update: How I’m Investing Now” where I predicted that the oil market would rebound quicker than people were expecting. I laid out three phases of the recovery process, with the last / third phase being characterized by oil inventories falling below pre-COVID levels and continuing to draw because of the multi-year underinvestment in supplies and structural damage to oil production from oil well shut-ins. I wrote:

As we have learned from Venezuela, Iran etc. once you damage the capital stock for oil producers, it’s extremely expensive to repair and restart. This is unlike a normal manufacturing process which can usually be shut down and restarted with minimal friction. Once an oil company shuts in a well, it may never restart the well as it may be uneconomic to do so until oil prices are much higher. Decline rates accelerate due to the lack of maintenance capex. This is especially true for older, depleted wells that are less productive.

With oil prices hovering at around $25 / bbl and having just recovered from a trip to -$40 / bbl, what I wrote at the time was hard for most to believe and easy to dismiss. The ‘oil is dead’ narrative remained mainstream. Since then oil has nearly quadrupled to $80+ / bbl and inventories have not only normalized to 2019 levels but are on track to hit the 2018 lows.

Despite this drastic change in fortunes, most generalist investors remain skeptical of oil price recovery. The consensus narrative seems to be that OPEC+ has enough spare capacity to cure the deficit and that US Shale will eventually start ramping up production causing the market to slip back into surplus.

Since the oil and gas sector has been out of favor in the investment community for more than half a decade, these narratives are not surprising to hear. Most investors haven’t really focused on the structural changes happening in the industry and are still extrapolating from historical trends. There simply hasn’t been much incentive to conduct any deep study into a sector that represents <3% of the S&P500, and with recent ESG mandates the oil sector remains the farthest thing from what most institutional investors would consider to be a core area of interest. This is why I think the handful of energy specialists who have been tracking the underlying fundamentals over the last few years have a strong edge and will likely outperform the market strongly over the next few years . Under the gut wrenching month to month and year to year volatility in the oil markets are strong structural undercurrents that will completely re-define how the world thinks about oil and the energy sector more broadly.

To address these structural undercurrents I wrote a series of blog posts in 2019 titled “What Is The End Game For The Oil Thesis?”. In Part I I talked about how the world had been under-investing in conventional oil supply and how this would lead to increasing decline rates which would become impossible to reverse in the near term given the long lead times needed to sanction and build such projects. In Part II I wrote about why we can’t rely on US Shale to fill the gap from lack of conventional project capex. And finally in Part III I talked about why OPEC+ spare capacity is not as high as it appears. I also talked about the limitations to OPEC+ spare capacity in my most recent oil market update.

Since most investors haven’t been studying these changes in the industry, they are still operating under old / stale assumptions regarding supply growth and a false narrative of abundance. This extends to the political sphere with recent comments from the Biden administration displaying a shocking lack of understanding of the forces at play.

The result of this energy ignorance will ultimately be a steadily worsening energy crisis as politicians and investors continue to ignore the root cause of the problem and continue searching for short-term stopgap measures (e.g. SPR release, or oil export ban) or offer up completely unrealistic ‘green’ alternatives (e.g. switching completely to electric cars in the next couple of years).

Short term solutions like an SPR release will only briefly pause the rally in oil prices and will most likely result in governments needing to re-fill their SPRs at higher oil prices down the road. These reserves are intended as a backup / safety measure to ensure supplies in the event of a natural catastrophe or military conflict and are not a ‘real’ source of supply. An oil export ban ignores the reality that refineries require different grades of crude to operate. Domestic refineries in the US as an example would need to continue to import heavy / medium grade crudes from Canada and the Middle East to operate. An export ban would simply create an oversupply of lighter grade crudes in the domestic market and cause a widening of the WTI-Brent spread which would hurt domestic producers with no noticeable impact on gasoline prices to the end consumer.

Even more bizarrely some world leaders are of the view that high oil prices are not a problem because we will all start driving electric vehicles in a few years and oil demand will collapse. The current global vehicle fleet is around 1.3bn vehicles, of which around 11mm are electric. Yes, that’s Billions with a B and Millions with an M. So with electric vehicles at just under 1% of the vehicle fleet, how exactly are politicians envisioning a drop in oil demand from EVs?

Assuming the global vehicle fleet grows by 2% a year, the number of cars on the road will increase by 25 – 30mm vehicles a year, so EV sales of 25mm-30mm are required (i.e. 3x the current EV fleet) just to keep oil demand FLAT. And this is assuming no growth in oil demand from air travel or petrochemicals which make up almost 60% of total oil consumption(!). Manufacturing EVs at this scale would require enormous volumes of raw materials like aluminum and lithium which are highly energy-intensive to produce. ~10% of oil demand comes from the mining sector. What do you think will happen to oil demand if we decided we wanted to triple the production of lithium and aluminum in short order? What kind of investments and lead time will be needed to produce these raw materials on such large scale?

Even if we leave all these issues aside and assume the world is able to miraculously achieve these absurdly unrealistic EV sales figures, the politicians will still need to address one more critical question: where will the power come from to charge the EVs? A quick look at the global power crisis and electricity shortages all over the world will immediately expose the vacuous nature of these claims.

Not only would the world need to invest massively in clean electricity sources, it would also have to develop the grid infrastructure (backup generation for renewables, charging stations etc.) to make mass EV adoption realistic. This is a multi-decade undertaking, not something that will be resolved over the next few years.

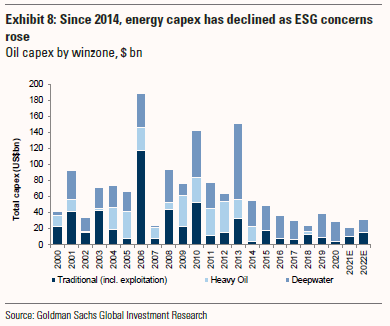

The root cause of the energy crisis which no one (except for a handful of specialist energy investors) seems to want to talk about is encapsulated by this chart from Goldman Sachs showing investment in the biggest oil projects they are tracking globally:

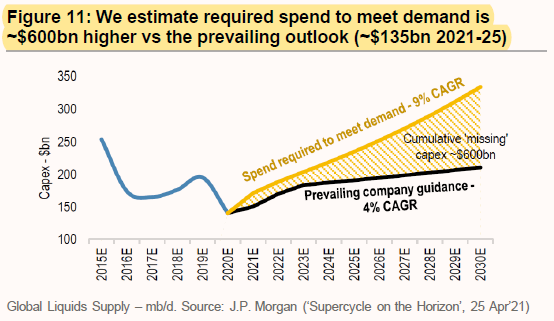

Here is another one from J.P. Morgan for a more comprehensive global oil capex outlook:

$600bn of ‘missing’ capex is not a problem that will be resolved by SPR releases or export bans. And wishful thinking about electric vehicle adoption and peak oil demand will only make this worse as it will continue preventing the necessary investments needed to ensure sufficient oil supplies for the future. In a way it’s already too late: even if oil companies started investing today, it’ll take 4-5+ years to bring new projects online which means that energy security will be a problem for the foreseeable future. With supply inelastic in the near term demand destruction will be the only way out, and it will happen not because of electric vehicle adoption as many believe, but sky high oil prices which will bring the world economy to its knees. The politicians and investors looking to OPEC+ or US Shale to increase supplies to lower oil prices should look at their own actions first. After sowing the seed for this energy crisis, they must now reap the consequences. Unfortunately it’s the working classes that will bear the brunt of their misguided policies.